Airtran 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

xUnder certain contracts with third parties, we indemnify the third party against legal liability arising ou

t

of an action by a third party. The terms of these contracts vary and the potential exposure under these

indemnities cannot be determined. Generally, we have liability insurance protecting us from obligations

undertaken under these indemnities.

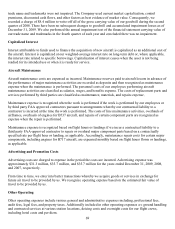

Taxes

We remit a variety of taxes and fees to various governmental authorities including: income taxes, transportation

fees and taxes collected from our customers, property taxes, sales and use taxes, payroll taxes, and fuel taxes.

The taxes and fees remitted by us are subject to review and audit by the applicable governmental authorities

which could result in liability for additional assessments. Contingencies for taxes, which are not based on

income, are accounted for in accordance with ASC 450 “Contingencies” (Contingencies Topic). Uncertain

income tax positions taken on income tax returns are accounted for in accordance with the Income Taxes Topic.

Although management believes that the positions taken on previously filed tax returns are reasonable, we

nevertheless have recorded accrued liabilities in recognition that various taxing authorities may challenge

certain of the positions we have taken, which may also potentially result in additional liabilities for taxes and

interest in excess of accrued liabilities. These accrued liabilities are reviewed periodically and are adjusted as

events occur that affect the estimates, such as: the availability of new information, the lapsing of applicable

statutes of limitations, the conclusion of tax audits, the measurement of additional estimated liability based on

current calculations, the identification of new tax contingencies, or the rendering of relevant court decisions.

Employees

As of December 31, 2009, approximately 52 percent of our employees were represented by unions. Our

agreement with our flight attendants became amendable in December 2008. Negotiations on proposed

amendments began in January 2008 and direct negotiations are continuing. The pilots’ collective bargaining

agreement became amendable in 2005 and is currently in mediation under the auspices of the National

Mediation Board. While we believe that our relations with labor are generally good, any strike or labor dispute

with our unionized employees may adversely affect our ability to conduct business. The outcome of our

collective bargaining negotiations cannot presently be determined. If we are unable to reach agreement with any

of our unionized work groups regarding the terms of their collective bargaining agreements or if additional

segments of our workforce become unionized, we may be subject to work interruptions or stoppages.

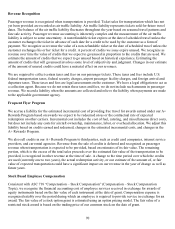

Litigation

A complaint alleging violations of federal antitrust laws and seeking certification as a class action was filed

against Delta Air Lines, Inc. (Delta) and AirTran in the United States District Court for the Northern District of

Georgia in Atlanta on May 22, 2009. The complaint alleges, among other things, that AirTran conspired with

Delta in imposing $15-per-bag fees for the first item of checked luggage. The initial complaint sought treble

damages on behalf of a putative class of persons or entities in the United States who directly paid Delta and/or

AirTran such fees on domestic flights beginning December 5, 2008. Subsequent to the filing of the May 2009

complaint, various other nearly identical complaints also seeking certification as class actions were filed in

federal district courts in Atlanta, Georgia; Orlando, Florida; and Las Vegas, Nevada. All of the cases were

consolidated before a single judge in Atlanta. An amended complaint filed in February 2010 in the consolidated

action broadened the allegations to add claims that Delta and AirTran also cut capacity on competitive routes

and raised prices. The amended complaint seeks injunctive relief against a broad range of alleged

anticompetitive activities and attorneys fees. AirTran denies all allegations of wrongdoing, including those in

the amended complaint, and intends to defend vigorously any and all such allegations.