Airtran 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.44

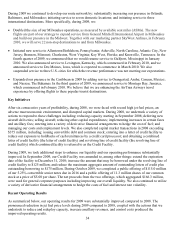

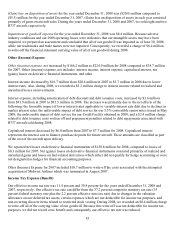

We determined that it was more likely than not that our deferred tax assets in excess of our deferred tax

liabilities would not ultimately be realized and that we were therefore required to provide a valuation allowance

on our deferred tax assets in excess of our deferred tax liabilities. As a result, beginning with the third quarter of

2008, our losses were not reduced by any tax benefit. Consequently, our effective tax rate for 2008 was

substantially lower than the statutory rate. As of December 31, 2008, we had recorded $84.1 million of

valuation allowance related to our net deferred tax assets.

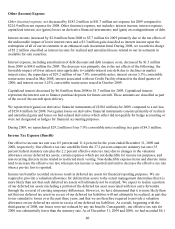

LIQUIDITY AND CAPITAL RESOURCES

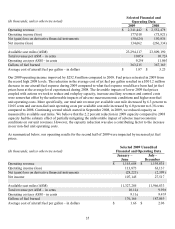

At December 31, 2009, we had aggregate unrestricted cash, cash equivalents, and short-term investments of

$544.3 million, and we also had $52.4 million of restricted cash. At December 31, 2009, we had $125 million of

borrowing outstanding under our revolving line of credit facility. During 2009, our primary sources of cash

were cash provided by operating activities, the issuance of debt and equity securities, borrowings under our

revolving line of credit facility, and borrowings to finance aircraft acquisitions. Our primary uses of cash were

repayment of long-term debt, repayment of borrowings under our revolving line of credit facility, and

expenditures for the acquisition of two B737 aircraft. As of February 1, 2010, we had no borrowing outstanding

under our revolving line of credit facility and a $50 million letter of credit had been issued under our letter of

credit facility. The letter of credit beneficiary was not entitled to draw any amounts as of February 1, 2010.

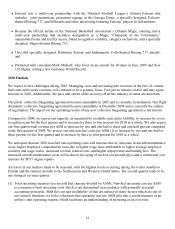

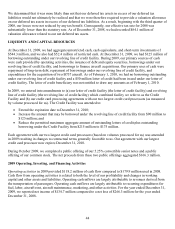

In 2009, we entered into amendments to (a) our letter of credit facility (the letter of credit facility) and revolving

line of credit facility (the revolving line of credit facility) which combined facility we refer to as the Credit

Facility and (b) our credit card processing agreements with our two largest credit card processors (as measured

by volume processed for us). The Credit Facility was amended to:

xExtend the expiration date to December 31, 2010;

xIncrease the amount that may be borrowed under the revolving line of credit facility from $90 million to

$125 million; and

xReduce the permitted maximum aggregate amount of outstanding letters of credit plus outstanding

borrowing under the Credit Facility from $215 million to $175 million.

Each agreement with our two largest credit card processors (based on volumes processed for us) was amended

in 2009 resulting in changes to contractual terms generally favorable to us. Our agreement with our largest

credit card processor now expires December 31, 2010.

During October 2009, we completed a public offering of our 5.25% convertible senior notes and a public

offering of our common stock. The net proceeds from these two public offerings aggregated $166.3 million.

2009 Operating, Investing, and Financing Activities

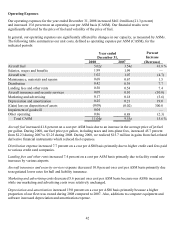

Operating activities in 2009 provided $118.2 million of cash flow compared to $179.9 million used in 2008.

Cash flow from operating activities is related to both the level of our profitability and changes in working

capital and other assets and liabilities. Operating cash inflows are largely attributable to revenues derived from

the transportation of passengers. Operating cash outflows are largely attributable to recurring expenditures for

fuel, labor, aircraft rent, aircraft maintenance, marketing, and other activities. For the year ended December 31,

2009, we reported net income of $134.7 million compared to a net loss of $266.3 million for the year ended

December 31, 2008.