Airtran 2009 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

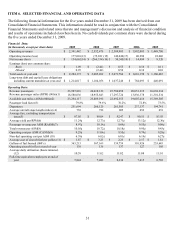

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

The information contained in this section has been derived from our historical financial statements and should

be read together with our historical financial statements and related notes included elsewhere in this document.

The discussion below contains forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-

looking statements involve risks and uncertainties including, but not limited to: consumer demand and

acceptance of services offered by us, our ability to achieve and maintain acceptable cost levels, fare levels and

actions by competitors, regulatory matters, general economic conditions, commodity prices, and changing

business strategies. Forward-looking statements are subject to a number of factors that could cause actual

results to differ materially from our expressed or implied expectations, including, but not limited to: our

performance in future periods, our ability to generate working capital from operations, our ability to take

delivery of and to finance aircraft, the adequacy of our insurance coverage, and the results of litigation or

investigation. Our forward-looking statements often can be identified by the use of terminology such as

“anticipates,” “expects,” “intends,” “believes,” “will” or the negative thereof, or variations thereon or

comparable terminology. Except as required by law, we undertake no obligation to publicly update or revise

any forward-looking statement, whether as a result of new information, future events or otherwise.

OVERVIEW

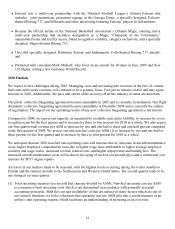

All of the flight operations of AirTran Holdings, Inc. (the Company, AirTran, or Holdings) are conducted by

our wholly-owned subsidiary, AirTran Airways, Inc. (AirTran Airways or Airways) (collectively we, our, or

us). AirTran Airways is one of the largest low cost scheduled airlines in the United States in terms of departures

and seats offered. We operate scheduled airline service throughout the United States and to selected

international locations. Approximately half of our flights originate or terminate at our largest hub in Atlanta,

Georgia and we serve a number of markets with non-stop service from our focus cities of Baltimore, Maryland;

Milwaukee, Wisconsin; and Orlando, Florida. As of February 1, 2010, we operated 86 Boeing B717-200

aircraft (B717) and 52 Boeing B737-700 aircraft (B737) offering approximately 700 scheduled flights per day

to 63 locations in the United States, including San Juan, Puerto Rico; as well as to Orangestad, Aruba; Cancun,

Mexico; and Nassau, The Bahamas. Our positive operating results in 2009 were based, in part, on traditional

elements of our success: competitive fares, superior service, an attractive network, and product value; low unit

costs; adaptability; flexibility; innovation; and the enthusiasm and skills of our employees.

Capacity and Network Changes

Prior to 2008, we positioned ourselves as a growth airline. We successfully grew our capacity (as measured by

available seat miles) at double-digit rates annually from 2000 through 2007. Nevertheless, in 2008, to respond

to the challenges of a volatile fuel cost environment, a weak macroeconomic environment, and adverse capital

market conditions, we recast our plans which resulted in our deferral of previously planned growth. We reduced

planned capacity, principally by deferring scheduled aircraft deliveries, and selling B737 aircraft. By adjusting

our business strategy and implementing revised tactics, we believe that we have positioned AirTran to more

effectively deal with a volatile fuel-cost environment and reduced demand for air travel due to weak

macroeconomic conditions. As a result of our actions, our capacity growth slowed to 4.9 percent in 2008, we

reduced capacity by 2.2 percent in 2009, and we currently expect our capacity to grow by three to four percent

in 2010.