Airtran 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.51

Income Taxes

We have not been required to pay significant federal or state income taxes since 1999 because we have had a

loss for federal income tax purposes in each of those years, in large part because tax basis depreciation has

exceeded depreciation expense calculated for financial accounting purposes.

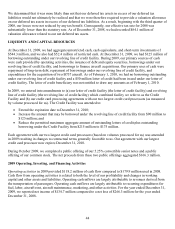

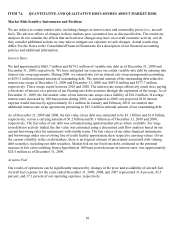

Our December 31, 2009 consolidated balance sheet includes gross deferred tax assets of $233.1 million and

gross deferred tax liabilities of $227.1 million. The deferred tax assets include $159.3 million pertaining to the

tax effect of $477.5 million of federal net operating losses (NOLs). Such NOLs, which expire in the years 2017

to 2029, are available to be carried forward to offset future taxable income and thereby reduce future income tax

payments. Our deferred income tax liability is in large part due to the excess of the financial statement carrying

values of owned flight equipment and other assets over the tax bases of such assets. Consequently, future tax

basis depreciation will tend to be lower than financial accounting depreciation for these assets.

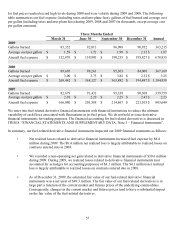

Income tax benefits recorded on losses result in deferred tax assets for financial reporting purposes. We are

required to provide a valuation allowance for deferred tax assets to the extent management determines that it is

more likely than not that such deferred tax assets will ultimately not be realized. We expect to realize a portion

of our deferred tax assets (including a portion of the deferred tax asset associated with loss carry-forwards)

through the reversal of existing temporary differences. However, we have determined that it is more likely than

not that our deferred tax assets in excess of our deferred tax liabilities will not ultimately be realized, in part due

to our cumulative losses over the past three years, and that we are therefore required to provide a valuation

allowance on our deferred tax assets in excess of our deferred tax liabilities. As of December 31, 2009, we had

recorded $6.1 million of valuation allowance related to our net deferred tax assets.

Regardless of the financial accounting for income taxes, our net operating loss carry-forwards currently are

available for use on our income tax returns to offset future taxable income.

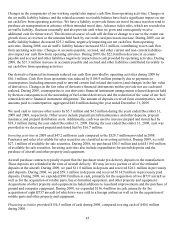

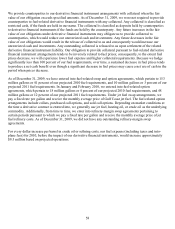

Section 382 of the Internal Revenue Code (Section 382) imposes limitations on a corporation’s ability to utilize

NOLs if it experiences an “ownership change.” In general terms, an ownership change may result from

transactions increasing the ownership of certain stockholders in the stock of a corporation by more than 50

percentage points over a three-year period. In the event of an ownership change as defined in the Internal

Revenue Code, utilization of our NOLs would be subject to an annual limitation under Section 382 determined

by multiplying the value of our stock at the time of the ownership change by the applicable long-term tax-

exempt rate. Any unused NOLs in excess of the annual limitation may be carried over to later years. As of

December 31, 2009, we believe that we were not subject to the limitations under Section 382.

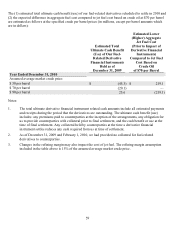

Off-Balance Sheet Arrangements

An off-balance sheet arrangement is any transaction, agreement or other contractual arrangement involving an

unconsolidated entity under which a company has (1) made guarantees, (2) a retained or a contingent interest in

transferred assets, (3) an obligation under derivative instruments classified as equity or (4) any obligation

arising out of a material variable interest in an unconsolidated entity that provides financing, liquidity, market

risk or credit risk support to the company, or that engages in leasing, hedging or research and development

arrangements with the company.

We have no arrangements of the types described in the first three categories that we believe may have a material

current or future affect on our financial condition, liquidity or results of operations. Certain guarantees that we

do not expect to have a material current or future effect on our financial condition, liquidity or resulted

operations are disclosed in ITEM 8. “FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA, Note 2

– Commitments and Contingencies.”