Airtran 2009 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2009 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

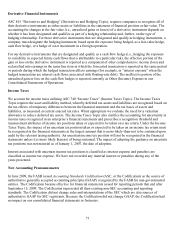

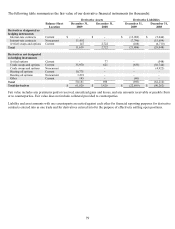

Note 4 –Debt

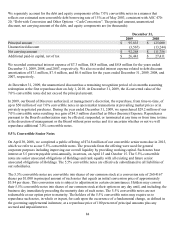

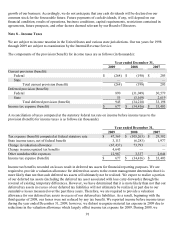

The components of debt were (in thousands):

December 31,

2009 2008

B737 Aircraft Purchase Financing Facilities:

Floating-rate aircraft notes payable through 2021, 1.91 percent weighted-

average interest rate as of December 31, 2009 (1) $ 665,694 $ 655,931

Fixed-rate aircraft notes payable through 2018, 7.02 percent weighted-

average interest rate as of December 31, 2009 52,901 61,014

Fixed-rate B717 aircraft notes payable through 2017, 10.21 percent

weighted-average interest rate as of December 31, 2009 76,708 80,854

Floating-rate B737 aircraft pre-delivery deposit financings payable

—

18,135

7.0% convertible senior notes due 2023 95,835 125,000

5.5% convertible senior notes due 2015 69,500 69,500

5.25% convertible senior notes due 2016 115,000

—

Other 1,120

—

Total long-term debt 1,076,758 1,010,434

Less unamortized debt discount (3,632)(13,244)

1,073,126 997,190

Less current maturities of long-term debt (156,004)(69,865)

Long-term debt less current maturities $ 917,122 $ 927,325

Borrowing under revolving line of credit facility $ 125,000 $ 90,000

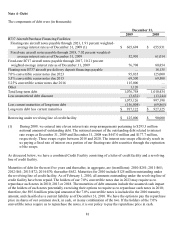

(1) During 2009, we entered into eleven interest rate swap arrangements pertaining to $293.3 million

notional amount of outstanding debt. The notional amount of the outstanding debt related to interest

rate swaps at December 31, 2009 and December 31, 2008 was $447.0 million and $177.7 million,

respectively. These swaps expire between 2018 and 2020. The interest rate swaps effectively result in

us paying a fixed rate of interest on a portion of our floating-rate debt securities through the expiration

of the swaps.

As discussed below, we have a combined Credit Facility consisting of a letter of credit facility and a revolving

line of credit facility.

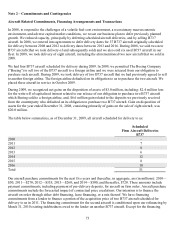

Maturities of debt for the next five years and thereafter, in aggregate, are (in millions): 2010-$281; 2011-$65;

2012-$61; 2013-$72; 2014-$70; thereafter-$652. Maturities for 2010 include $125 million outstanding under

the revolving line of credit facility. As of February 1, 2010, all amounts outstanding under the revolving line of

credit facility have been repaid. The holders of our 7.0% convertible notes due in 2023 may require us to

repurchase such notes in 2010, 2013 or 2018. The maturities of debt amounts include the assumed cash impact

of the holders of such notes potentially exercising their options to require us to repurchase such notes in 2010;

therefore, the $95.8 million principal amount of the 7.0% convertible notes is included in the 2010 maturity

amount, and classified as a current liability as of December 31, 2010. We have the option to pay the repurchase

price in shares of our common stock, in cash, or in any combination of the two. If the holders of the 7.0%

convertible notes require us to repurchase the notes, it is our policy to pay the repurchase price in cash.