Airtran 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

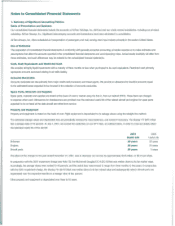

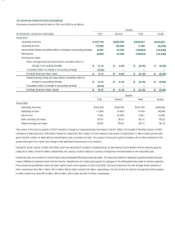

8. Leases

Total rental expense charged to operations for aircraft, facilities and office space for the years ended December

31,

2001, 2000 and 1999 was

approximately $56.7 million, $30.9 million and $21.7 million, respectively.

We tease six DC-9s, one

8737

and 22 8717s under operating leases with terms that expire ttlrough 2020. We have the option to renew the DC-9

leases for one or more periods

of

not less than six months. We have the option to renew the 8717 leases for periods ranging from one to four

years. The 8717 leases have purchase options

at

or near the end of the lease term

at

fair market value, and

two

have purchase options based on a

stated percentage of the lessor's defined cost

of

the aircraft

at

the end

of

the 13th year

of

the lease term. TIle 8717 leases

are

the result of sate and

leaseback transactions. Deferred gains from these transactions are being amortized over the terms

of

the leases. At December

31,

2001 and 2000,

unamortized deferred gains were $44.1 million and

$10.1

million, respectively. See Note

6.

We also lease facilities from local airport authorities or other

carriers, as well as office space under operating leases with terms ranging from one month to

13

years.

In

addition, we lease ground equipment and

certain rotables under capital leases.

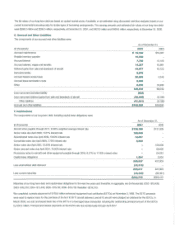

The amounts applicable to capital leases included

in

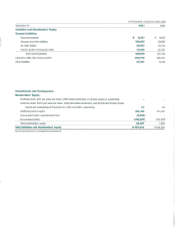

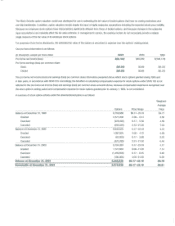

property and equipment were:

As

of

December

31,

(In

thousands)

Flight equipment

Less: Accumulated depreciation

2001

2000

$2,627

$2,627

(285)

(111)

$2,342

$2,516

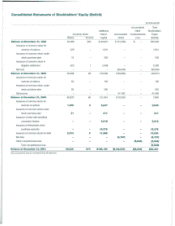

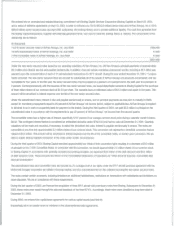

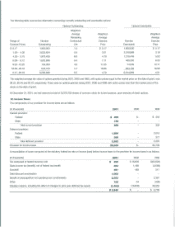

The following schedule outlines the future minimum lease payments at December

31,

2001, under noncancelable operating leases and capital leases

with initial terms

in

excess

of

one year:

(In

thousands)

2002

2003

2004

2005

2006

Thereafter

Total mini!llum lease payments

Less: amount representing interest

Present value of future payments

Less: current obligations

Long-term obligations

Capital lease obligations are included

in

long-term debt in our Consolidated Balance Slleets.

Capital

Leases

$564

565

535

95

1,759

(165)

1,594

(482)

$1,112

Operating

Leases

$81,192

81,123

76,303

74,313

72,687

668,032

$1,053,650

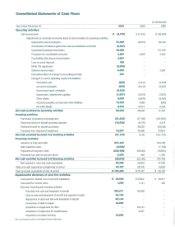

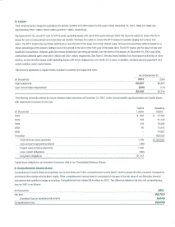

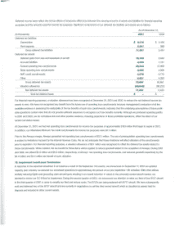

9.

Comprehensive

Income

(Loss)

Comprehensive income (loss) encompasses net income (loss) and "other comprehensive income

{loss),"

which includes all other nonowner transactions

and events that change stockholders' equity. Other comprellensive income (loss)

is

composed

of

changes

in

the fair value

of

our derivative financial

instruments that qualify for hedge accounting. Comprehensive loss totaled $6.8 million for 2001. The difference between net loss and comprehensive

loss for 2001

is

as follows:

(In

thousands)

Net loss

Unrealized loss on derivative instruments

Comprehensive loss

2001

$(2,757)

(6,846)

$(9,603)