Airtran 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

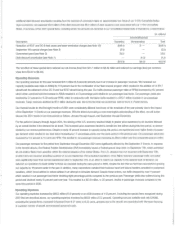

Other revenues decreased $18.0 million (54.4 percent). Excluding alitigation settlement gain

of

$19.6 million

in

1999, other revenues increased $1.6

million or

12.1

percent on ayear-over-year basis.

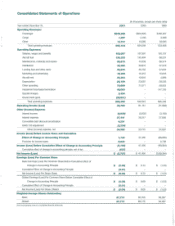

Operating Expenses

Operating expenses decreased by $52.5 million (8.8 percent). Excluding the 1999 pre-tax

SFAS

121

impairment charge

of

$147.7 million to reduce

the book value of our DC-9 aircraft, operating expenses increased by $95.2 million or 21.3 percent. CASM increased by 13.2 percent, primarily due

to a105.5 percent increase

in

aircraft fuel expense. Excluding fuel costs, CASM decreased approximately

1.0

percent to 6.9 cents per ASM.

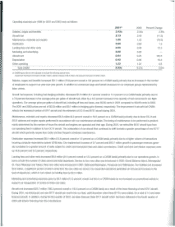

Salaries, wages and benefits increased $16.7 million (13.8 percent overall

or

5.9 percent on aCASM basis) primarily due to contractual wage rate

increases and additional personnel required for the higher

level

of

operations

in

2000.

Aircraft fuel expense increased

$72.1

million (105.5 percent overall or 92.0 percent on aCASM basis) primarily due to increases

in

the cost

of

fuel.

During 2000, the average cost

of

aircraft fuel per gallon was approximately $1.01, compared to an average cost per gallon

in

1999

of

approximately

$0.50. The cost of aircraft fuel was net

of

approximately $5.3 million and $14.2 million in gains from hedging activities

in

2000 and 1999, respectively.

Maintenance, materials and repairs decreased

$13.1

million (15.2 percent overall or 20.9 percent

on

aCASM basis) primarily due to alesser number

of

8737

and DC-9 airframe and engine repairs performed during 2000

in

accordance with

our

maintenance schedule. The timing

of

maintenance to

be performed

is

determined by the number

of

hours the aircraft and engines are operated and their age.

Distribution expenses increased $2.7 million

(7.2

percent overall, but flat on aCASM basis) primarily due to an increase

in

commissionable sales

generated by travel agents, offset by arate reduction from 8.0 percent to 5.0 percent during the fourth quarter

of

1999.

Landing fees and other rents increased $1.7 million (6.5 percent overall, but flat on aCASM basis) primarily due to increased departures. On aCASM

basis, these expenses remained flat on ayear-over-year basis. We operated 101,644 departures

in

2000 and 96,858 departures

in

1999, an increase

of

4.9 percent.

Aircraft rent increased $7.7 million

(159.1

percent overall or 144.4 percent on aCASM basis) primarily due to the lease financing associated with five

of

the eight new 8717s delivered during 2000, as well as the sale-leaseback of seven DC-9 aircraft

in

the fourth quarter of 1999.

Depreciation expense decreased $5.4 million

(19.1

percent overall or 25.0 percent on aCASM basis) primarily due to the reduction

in

book

value of

our DC-9 fleet as aresult

of

the 1999 SFAS

121

impairment charge and the sale-leaseback

of

seven DC-9 aircraft

in

the fourth quarter

of

1999.

Other operating expenses increased

$12.1

million (20.6 percent overall or 13.0 percent on aCASM basis) primarily due to increased passenger related

expenses associated with the greater number of passengers served, and to costs related to supporting and maintaining our existing automation systems.

Impairment loss/lease termination expenses reflect the decision we made

in

the fourth quarter

of

1999 to accelerate the retirement

of

our owned DC-9

fleet to accommodate the introduction

of

the 8717 fleet. This $147.7 million impairment charge was recorded

in

accordance with

SFAS

121

and is

discussed

in

Note

13

to the consolidated financial statements.

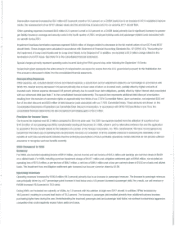

Nonoperating Expenses

Interest expense, net, increased 36.7 percent, primarily due to the debt financing of eight 8717 aircraft delivered

in

the third and fourth quarters

of

1999, as well as three 8717s delivered in the fourth quarter 2000. The 1999 deliveries were financed utilizing the proceeds from the issuance

of

enhanced equipment trust certificates (EETCs). Three of the 2000 deliveries were financed utilizing

debt

issued by an affiliate of the airframe manu-

facturer. Offsetting aportion

of

the Increased Interest expense, interest income increased 76.0 percent as aresult

of

higher invested cash balances.

Provision for

Income

Taxes

As

of

December

31,

2000,

we

had not recognized any benefit from the future use

of

operating loss canyforwards, because our evaluation

of

all the

available evidence

in

assessing the realizability

of

tax benefits

of

such loss carryforwards indicated that the underlying assumptions

of

future profitable

operations contained risks that did not provide sufficient assurance to recognize such tax benefits at that time. As aresult, income tax expense

was

$0

and $2.7 million

in

2000

and 1999, respectively. The 1999 tax expense resulted from the utilization

of

aportion

of

our $141.0 million

of

NOL