Airtran 2001 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

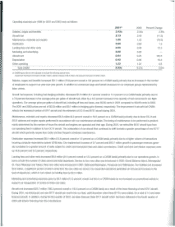

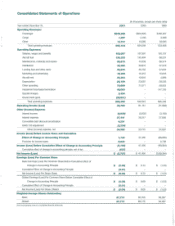

Depreciation expense increased by

S5.1

million (22.0 percent overall or 10.3 percent on aCASM basis) due to an increase in DC-9 capitalized improve-

ments, the reassessment

of

our B737 salvage values and the provisioning

of

spare parts for

our

growing B717 aircraft fleet.

Other operating expenses increased $8.6 million

(12.1

percent overall or 0.8 percent

on

aCASM basis) primarily due

to

significant increases

to

passen-

ger liability insurance coverage and security costs in the fourth quarter

of

2001, employee training costs and passenger-related costs associated with

our growth during 2001.

Impairment loss/lease termination expenses represent $38.8 million

of

charges related to decreases in the fair market values

of

our DC-9 and B737

aircraft fleets. These charges were calculated

in

accordance with Statement

of

Financial Accounting Standards No.

121

(SFAS

121),

"Accounting for

the Impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed

of."

In

addition, we recorded a$7.3 million charge related to the

termination

of

a

8737

lease. See Note

13

to the consolidated financial statements.

Special charges primarily represent operating costs incurred during the

FAA's

ground stop order following the

september

11

Events.

Government grant represents the entire amount

of

compensation

we

expect to receive from the U.S. government pursuant to the Stabilization Act.

This amount is discussed in Note 3to the consolidated financial statements.

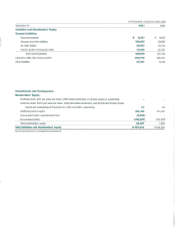

Nonoperating Expenses

Other expense, net, included interest income and interest expense, aspecial item and an adjustment related to

our

fuel hedges in accordance with

SFAS 133. Interest income decreased

11.5

percent primarily due

to

lower rates

of

return on invested cash, partially offset

by

higher amounts

of

invested cash. Interest expense decreased 4.8 percent primarily due to overall lower debt obligations. partially offset

by

higher interest rates associated

with our refinanced

debt

(see Note 7to the consolidated financial statements). The special item represents additional

debt

discount amortization

resulting from the exercise

of

conversion rights on approximately two·thirds

of

our 7.75% Convertible Noles. Upon conversion.

we

expensed $3.8 mil-

lion

of

the

debt

discount and $0.5 million

of

debt issuance costs associated with our 7.75% Convertible Notes. These amounts are shown on the

Consolidated Statements

of

Operations as Convertible Debt Discount Amortization.

In

accordance

willl

SFAS

133 (see Notes 5and 16 to the

consolidated financial statemenls) we also recognized fuel-hedging gains of $2.2 million.

Provision for Income Taxes

Our income tax expense was $3.2 million compared to

SO

in the prior

year.

The 2001 tax expense resulted from the utilization

of

aportion

of

our

8141.0 million

of

net operating loss (NOL) carryforwards existing at December 31. 1998. offset in part

by

alternative minimum tax and the application

to goodwill

of

the tax benefit related

to

the realization of aportion of the Airways

Cor~ation,

Inc.

NOL

carryforwards. We have not recognized any

benefit from the future use

of

operating loss carryforwards, because

our

evaluation

of

all the available evidence in assessing the realizability

of

tax

benefits

of

such loss carryforwards indicates that the underlying assumptions

of

ruture profitable operations contain risks that do not provide sufficient

assurance

to

recognize such tax benefits currently.

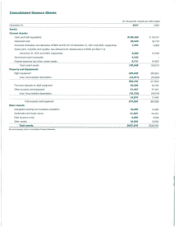

2000

Compared to

1999

Summary

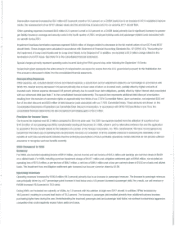

For 2000,

we

recorded operating income

of

$81.2 million, pre-tax income and net income

of

$47.4 million and earnings per common share

of

$0.69

on adiluted basis. For 1999, including apre-tax impairment charge

of

$147.7 million and alitigation settlement gain

of

$19.6 million, we recorded an

operating loss of $72.0 million, apre-tax loss

of

$96.7 million, anet loss of $99.4 million and aloss per

common

share

of

$1.53 on abasic and diluted

basis. The impairment loss and litigation settlement gain increased our loss per

common

share

by

S1.98.

Operating Revenues

Operating revenues increased by

S1OO.6

million (19.2 percent) primarily due to an increase in passenger revenues. The increase in passenger revenues

was principally driven

by

a6.7 percentage point increase

in

load factor and a4.9 percent increase in passenger yield. As aresult.

our

unit revenue or

RASM increased 16.0 percent to 10.3 cents.

During 2000. we increased

our

capacity, or ASMs. by

7.2

percent with the addition

of

eight new 8717 aircraft.

In

addition, RPMs increased

by

18.5 percent, resulting in arecord load factor

or

70.2 percent. The increase

in

passenger yield resulted primarily from additional business travelers

purchasing higher fares during the

year.

Notwithstanding the improved passenger yield and passenger load factor,

we

continue to experience aggressive

competition that could negatively impact future yields and loads.