Airtran 2001 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

t

carryforwards existing at December 31. 1998, offset

in

part

by

alternative minimum tax and the application to goodwill

of

the tax benefit related

to the realization

of

aportion

of

the Airways Corporation, Inc.

NOL

carryforwards.

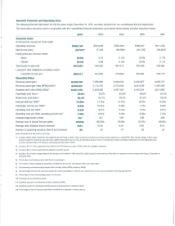

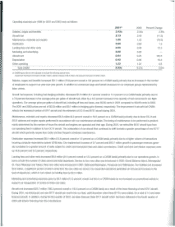

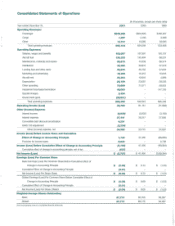

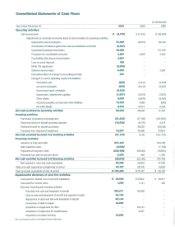

Liquidity and Capital Resources

We

rely

primarily on operating cash flows to provide working capital. We presently have no lines

of

credit or stlOrt-term borrowing facilities. As

of

December

31,

2001,

our

cash and cash equivalents, including restricted cash, totaled $130.0 million compared to $103.8 million at December

31,

2(X)().

The deferral

of

$16.5 million in excise tax payments until January 2002

in

accordance with the Stabilization Act is reflected

in

our 2001 year-end

cash balance. We generally must satisfy all

of

our working capital expenditure requirements from cash provided by operating activities. from external

capital sources or from the sale

of

assets. Substantial portions

of

our assets have been pledged to secure various issues

of

our outstanding indebted-

ness.

To

the extent the pledged assets are sold, the applicable financing agreements generally require the sales proceeds to be applied to repay the

corresponding indebtedness.

To

the extent our access to capital is constrained,

we

may not

be

able to make certain capital expenditures

or

continue

to implement certain other aspects

of

our strategic plan.

As

of

December

31,

2001, our cash and cash equivalents including restricted cash increased by $26.2 million compared to December

31,

2000.

Net cash provided by operating activities was $95.4 million for 2001, a$26.0 million increase over the prior

year.

Our operating cash flow results

for 2001 reflect the receipt

of

$24.6 million from the U.S. Department of Transportation and the deferral

of

$16.5 million

in

excise tax payments until

January 2002

in

accordance with the Stabilization

Act.

Net cash used for investing activities was $31.2 million and consisted

of

purchases

of

property and equipment

and

the payment

of

aircraft purchase

deposits offset in part

by

proceeds from the disposal

of

equipment.

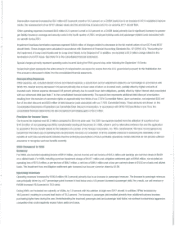

In

2001,

we

sold

17

B717s

(14

of

which were acquired from Boeing during 2001,

as discussed below) under our lease financing commitment with Boeing capital Services Corporation (Boeing

CapitaO.

Our lease financing commit-

ment was for the purchase and sale-leaseback

of

up

to

20

8717s.

8y

the end

of

2001 all

20

aircraft under this commitment were purchased with

corresponding sale-leaseback transactions completed. Related to the refinancing

of

certain debt obligations (see "Other Information" below), Boeing

Capital's purchase price under the lease financing commitment was increased by

$3.1

million per aircraft for the fourth ttlrough twentieth B717 deliv·

eries,

or

$52.7 million

in

the aggregate. The majority of these transactions with Boeing Capital, including the related

debt

repayments

(see

"Other Infor·

mation" below). are noncash items. Our property and equipment purchases primarily consisted

of

spare parts and equipment provisioning for the 8717

aircraft, and to alesser extent capital expenditures on leasehold improvements and computer equipment

to

support our operations growth particularly

in the three new cities

now

served.

In

2001,

we

paid $13.3 million

in

purchase deposits for future 8717 aircraft deliveries.

Net cash used for financing activities was primarily related to the refinancing

of

certain

debt

obligations associated with the 80eing Capital transactions

(see "Other Information" below).

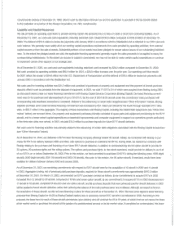

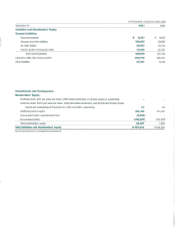

As

of

December

31,

2001, our deliveries

of

8717s from the Boeing Company (Boeing) totaled 30 aircraft. Initially,

we

contracted with Boeing to pur-

chase

50

8717s for delivery between 1999 and 2002, with options to purchase an additional

50

8717s. During 2000, we revised our contracts with

Boeing relating to the purchase and financing

of

our

future B717 aircraft deliveries.

in

addition to recharacterizing the

50

option aircraft to provide for

25

options.

20

purchase rights and

fIVe

rolling options. The options and purchase rights. to the extent exercised. would provide for delivery

to

us

of

all

of

our

8717s

on

or before September 30, 2005. Prior to this revision.

we

had committed to purchase

50

8717s during the following years: 1999 (eight

aircraft).

2000

(eight aircraft), 2001 (16 aircraft) and 2002 (18 aircraft). Also prior to the revision, the

50

option aircraft, if exercised, would have been

available lor delivery between January 2003 and January 2005.

/J.s

of

December 31, 2001. our remaining commitments with respect to 8717 aircraft were for the acquisition

of

12

aircraft in 2002 and

11

aircraft

in 2003. Aggregate funding, net

of

previously paid purchase deposits, required for these aircraft commitments was approximately $470.2 million

at December

31,2001.

On March

21,

2002. we amended our B717 purchase contract as follows:

(i)

our commitments to acquire B717s

in

2002

increased from

12

aircraft to

20

aircraft. comprised of 13 firm and seven option aircraft;

(ii)

our

commitments to acquire 8717s

in

2003 decreased from

11

aircraft to 10 aircraft, comprised

of

nine firm and one option aircraft; and (iiij purchase deposits that were previously paid for aircraft deliveries

in

2002

will

be

applied

10

future aircraft deliveries, rather than reducing the balance

of

the total purchase price due at delivery. Although

we

expect to finance

the acquisition

of

these aircraft.

we

did not have financing in place for these aircraft as

of

December

31,

2001. We have since signed alease financing

proposal from Boeing capital for

19

(20 at Boeing Capital's option)

new

or previously owned 8717 aircraft to

be

delivered in 2002. According to this

proposal. the lease term for each

of

these aircraft commences upon delivery and will continue lor

18

to

19

years. at which time

we

can renew the lease

at fair market rental or purchase the aircraft at the greater of apredetermined amount or its fair market value.

If

completed as contemplated, this lease