Airtran 2001 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Jl

financing will reduce our aggregate funding requirements for aircraft commitments to £211.3 million representing the aircraft to be purchased in 2003.

Funding is subject to finalization

of

definitive agreements and other conditions.

See

Note 4to the consolidated financial statements.

With respect to future B717 option deliveries,

we

had

21

options,

20

purchase rights and five rolling options at December

31,

2001. Three

of

the 25

options were exercised with

two

B717s having been delivered

in

2001, and one 8717 exercised for ascheduled delivery in 2003; one option expired

unexercised.

In

connection with the amendments discussed above,

we

will exercise an additional seven options, for which no additional purchase

deposit payments will be required, with delivery scheduled for 2002.

If

we

exercise our options to acquire additional aircraft, additional payments could

be required for these aircraft beginning

in

2002. There can be no assurance that sufficient financing will be available for

all

aircraft and other capital

expenditures not covered by firm financing commitments.

During 2001, we took delivery 0114 new B717 aircraft that were financed by Boeing Capital as follows: 13 were delivered and simultaneously sold and

leased-back from Boeing Capital, and one was purchased with aloan provided by Boeing Capita! (the loan was fully repaid in February 2001 and the

aircraft was contemporaneously sold and leased-back from Boeing Capital).

/J.s

of December

31,

2001, our

debt

obligations totaled $268.2 million, with respect to which substantially all our assets are pledged as security. Our

debt obligations are comprised

of

$130.2 million

of

10.63% EETGs,

of

which aportion

of

interest and principal is payable semiannualty through April

2017, and certain

debt

obligations due to Boeing Capital, as described in Other Information below. The EETG proceeds were used to replace loans for

the purchase

of

the first

10

B717 aircraft delivered

(all

10

aircraft were pledged as collateral for the EETGs). Eight EETC-financed B717s were delivered

in

1999, and the remaining two deliveries occurred in 2000. During 2000, we sold and leased back two

of

the EETC-financed B717s in aleveraged

lease transaction reducing the outstanding principal amount

of

the EETGs by $35.9 million.

In

addition to our £130.0 million in cash, cash equivalents and restricted cash as

of

December

31,

2001.

we

have other financing sources available

to meet our future liquidity requirements, including, but not limited to:

(i)

the receipt

of

the remaining $4.3 million

of

the U.S. government grant;

(ii)

securitization

of

future operating receipts;

(iii)

unsecured borrowings; and

(iv)

any borrowings backed by federal loan guarantees pursuant to

the Stabilization Act.

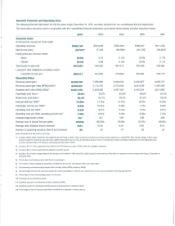

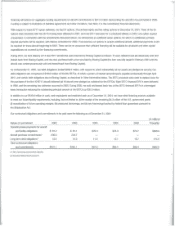

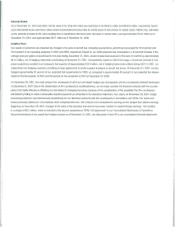

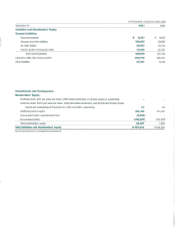

Our contractual obligations and commilments to be paid were the following as

of

December

31,

2001:

(In

millions)

Nature

of

commitment 2002 2003 2004 2005 2006 1hereafler

Operating lease payments for aircraft

and facility obligations $81.2 $81.1 $76.3 $74.3 $72.7

$668.0

Aircraft purchase commitments'"236.5 233.7

Long-term debt obligalions:ll 13.4 10.3 11.5 15.1 15.7 214.5

Total contractual obligations

and commitments $331.1 8325.1 887.8 889.4 888.4 $882.5

(1)

Net

0'

previously paid purchase deposits.

(2)

Excludes related interest paymenlS.