Airtran 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

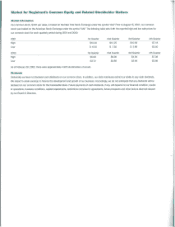

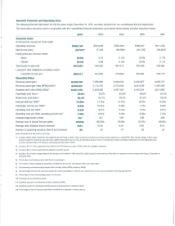

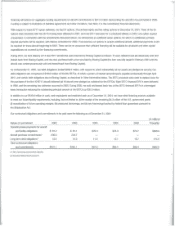

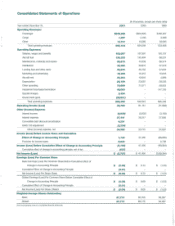

Operating expenses per ASM for 2001

and

20CXJ

were as follows:

2001

(

1)

2000 Percent Change

Salaries, wages

and

benefits

2.43C

2.34C

3.8%

Aircraft fuel

2.13

2.40 (11.3)

Maintenance. materials and repairs

1.05

1.25 (16.0)

Distribution

0.69

0.68

1.5

Landing fees

and

other rents

0.55

0.49

12.2

Marketing and advertising

0.28

0.28

Aircraft rent

0.54

0.22 145.5

Depreciation

0.43

0.39 10.3

Other operating

1.23

1.22 0.8

Total CASM

9.33C

9.27c

0.6%

(1)

CASM

figures

above

were

~ted

to

exclude

the following specl3lllems:

Impaarment lossIIease lermnatlOn

of

$46.1

1TiIion.

special charges of $2.5 milion

and

agovernment grant

of

$29.0 million.

Salaries. wages

and

benefits increased $21.7million (15.8 percent overall

or

3.8 percent

on

aCASM basis) primarily

due

to

increases

in

the

number

of

employees

to

support

our

year-aver-year growth,

in

addition

to

contractual wage

and

benefit increases for our employee groups represented by

labor unions.

Aircraft fuel expense, including fuel-hedging activities, decreased $1.0 million (0.7 percent overall

or

11.3

percent on aCASM basis) primarily due

to

a7.0 percent decrease

in

the average price per gallon

of

aircraft fuel, offset by a6.5 percent increase

in

the quantity

of

fuel

consumed

in

our flight

operations. Our average price per gallon of aircraft fuel. including all fees and taxes. was 93.85 cents in 2001 compared to 100.89 cents

in

2000.

The 2001 and 2000 prices are net

of

$(2.5) million and

$5.1

million

in

hedging gains (losses), respectively. The improvement

in

aircraft fuel CASM

reflects the increased number

of

B717 aircraft and the retirement

of

DC-9 and B737 aircraft during 2001.

Maintenance. materials and repairs decreased $4.6 million (6.2 percent overall

or

16.0 percent on aCASM basis) primarily due

to

fewer DC-9 and

B737 airframe and engine repairs performed

in

accordance with our maintenance schedule. The timing

of

maintenance

to

be performed is predomi-

nantly determined by the

number

of

hours the aircraft and engines are operated and their age. During 2001.

we

retired the

8737

aircraft type from

our operating fleet

in

addition

to

four

DC-9

aircraft. The composition

of

our aircraft neet continued

to

shift towards agreater percentage

of

new

B717

aircraft which generally require less costly

and

less frequent scheduled maintenance.

Distribution expenses increased $5.4 million (13.6 percent overall

or

1.5

percent

on

aCASM basis) primarily

due

to

ahigher volume

of

transactions

incurring

computer

reservations system (CRS) fees.

Our

enplanement increase

of

9.7 percent

and

$43.7 million growth in passenger revenues gener-

ally correlated

to

agreater amount

of

sales subject

to

credit card transaction fees

and

sales commissions. Credit card and commission expenses were

up

10.6 percent

and

6.2

percent.

respectively.

Landing fees and other rents increased

$6.9

million

(24.1

percent overall

or

12.2 percent

on

aCASM basis) primarily

due

to

our operations growth, in

terms

of

both

the

number

of

cities served and total departures.

service

to

four

new

cities was introduced in 2()()(): Grand Bahama Island, Minneapolis!

St. Paul, Pittsburgh

and

Toledo; three

new

cities were introduced

in

2001: BaltimorelWashington, Pensacola

and

Tallahassee. Our facilities rent increased

85.0

million, asignificant portion

of

which came from the

new

cities we served.

Our

expanded operations generated an 8.8 percent increase in the

level

of

departures, which in turn raised our landing fees

by

$2.2 million.

Marketing

and

advertising expenses grew by

52.1

million (12.5 percent overall.

but

flat on aCASM basis)

as

we

increased

our

promotional activity to

support

our

inauguration

of

service

to

three

new

cities.

Aircraft rent increased $22.7 million (180.3 percent overall

or

145.5 percent

on

aCASM basis) as aresult

of

the lease financing

of

new

B717 aircraft.

During 2001.

we

introduced one

new

8717 aircraft per month into our fleet, until December when three B717s were added, for atotal

of

14

new

lease

financed aircraft.

In

addition. during the first quarter

of

2001.

we

lease financed three B717 aircraft which had been delivered

in

the fourth quarter

of

2000 with interim financing from the manufacturer.