Airtran 2001 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

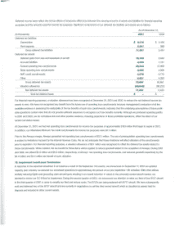

We entered into an amended and restated financing commitment with Boeing capital services Corporation (Boeing Capital)

on

March 22, 2001,

and aseries

of

definitive agreements

on

April 12, 2001, in order to refinance our

10:.1%

($150.0 million) senior notes and AirTran Airways, lnc.'s

10~%

($80.0 million) senior secured notes due April 2001 (collectively, the Existing Notes), and to provide additional liquidity. The cash flow generated from

the Boeing Capital transactions, together with internally generated funds, was used to retire the Existing Notes at maturity. The components

of

the

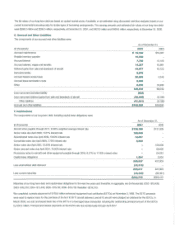

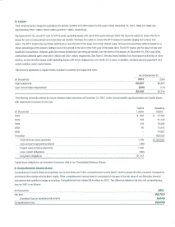

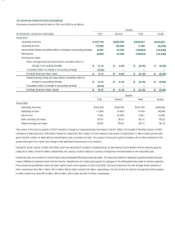

refinancing are as follows:

(In

thousands)

11.27% Senior secured notes

of

AirTran Airways, Inc. due

2008

13.00% Subordinated notes

of

AirTran Holdings, Inc. due

2009

7.75% Convertible notes

of

AirTran Holdings, Inc. due

2009

$166,400

17,500

17,500

$201,400

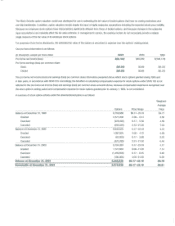

Under the new senior secured notes issued by our operating subsidiary, AirTran Airways, Inc. (AirTran Airways), principal payments

of

approximately

$3.3 million plus interest are due and payable semiannually.

In

addition, there

are

certain mandatory prepayment events, including a

$3.1

million pre-

payment upon the consummation

of

each of

11

sale-leaseback transactions for B717 aircraft. During the year ended December

31,2001,11

prepay-

ments occurred. The

new

senior secured notes are secured

by

substantially all

of

the assets

of

AirTran Airways not previously encumbered, and are

noncallable for four years. In the fifth

year,

the senior secured notes may

be

prepaid at apremium

of

4percent and in the sixth year at apremium

of

2percent. Contemporaneously with the issuance

of

the new senior secured notes,

we

issued detachable warrants to Boeing capital for the purchase

of

three million shares

of

our

common

stock at $4.51 per share. The warrants have an estimated value

of

812.3 million and expire in

fIVe

years. This

amount will

be

amortized to interest expense over the life

of

the new senior secured notes.

Under the subordinated notes, interest

is

due and payable semiannually in arrears, and no principal payments are due prior to maturity

in

2009,

except for mandatory prepayments equal to 25 percent

of

AirTran Airways' net income (whicll, subject to applicable law, AirTran Airways

is

required

to dividend to us

in

cash on aquarterly basis for payment to the lender). During the third quarter

of

2001, we paid $3.3 million

in

principal on the

subordinated notes in accordance with the requirements to pay

25

percent

of

AirTran Airways' net income from the second quarter.

The convertible notes bear ahigher rate

of

interest, specifically 12.27 percent if

our

average

common

stock price during acalendar month

is

below

$6.42. This contingent interest feature is considered an embedded derivative under SFAS 133 and had no value at December

31,

2001. Quarterly

valuations will be made and recorded, if necessary,

10

reflect the derivative's fair value. Interest

is

payable semiannually in arrears. The notes are

convertible at any time into approximately 3.2 million shares

of

our

common

stock. This conversion rate represents abeneficial conversion feature

valued at $5.6 million. This amount will be amortized to interest expense over the life

of

the convertible notes, or sooner upon conversion. We are

able to require Boeing Capital's conversion of the notes under certain circumstances.

During the third quarter

of

2001, 80eing Capital exercised approximately two-thirds

of

tf1eir

conversion rights resulting in adecrease of $12 million

of

principal

on

the 7.75% Convertible Notes.

In

connection with the conversion,

we

issued approximately 2.2 million shares

of

our common stock

to Boeing Capital.

In

accordance with generally accepted accounting principles,

we

expensed S3.8 million

of

the

debt

discount and

SO.5

million

of

debt issuance costs. These amounts are shown

on

the Consolidated Statements

of

Operations as

~Other

(Income) Expense-Convertible debt

discount amortization."

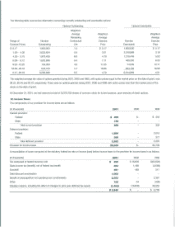

The subordinated notes and convertible notes are secured by:

(1)

apledge

of

all

of

our rights under the 8717 aircraft purchase agreement with the

McDonnell Douglas Corporation

(an

affiliate of Boeing Capital), and

(2)

asubordinated lien on the collateral securing the new senior secLlred notes.

TIle notes contain certain covenants, including limitations on additional indebtedness, restrictions on transactions with subsidiaries and limitations on

asset disposals. We are

in

compliance with these requirements.

During the last quarter

of

2000,

we

financed the acquisition

of

three 8717 aircraft with promissory notes from Boeing. Subsequent to December

31,

2000, these notes were

repak1

through the sale

and

leaseback

of

the three 87175. Accordingly, these notes were classified as long-term

debt

at

o.c..nber31,2ooo.

During 2000. we entered into capital lease agreements for various capital assets (see Note

8).

Substantially

all

of

our assets serve as collateral on the aforementioned

debt

agreements.