Airtran 2001 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

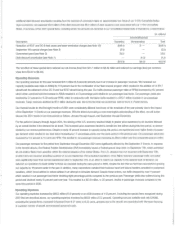

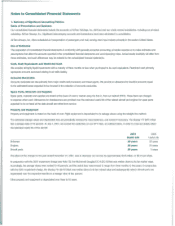

Interest

Rates

As of December

31,

2001 and 2000, the fair value of our long-term debt was estimated to be $258.5 million and $439.0 million, respectively, based

upon discounted future cash flows using current incremental borrowing rates for similar types

of

instruments or market prices. Market risk, estimated

as the potential increase

in

fair value resulting from ahypothetical 100 basis point decrease

in

interest rates, was approximately $12.6 million as

of

December

31.

2001, and approximately

$11.1

million as

of

December

31,

2000.

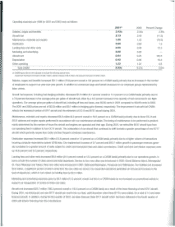

Aviation Fuel

Our results

of

operations are impacted by changes

in

the price

of

aircraft fuel. Excluding special items, aircraft fuel accounted for 22.9 percent and

25.9 percent of our operating expenses

in

2001 and 2000, respectively. Based on our 2002 projected fuel consumption, a

10

percent increase

in

the

average price per gallon

of

aircraft fuel for the year ending December

31,

2001, would increase fuel expense for the next

12

months by approximately

$14.4 million, net

of

hedging instruments outstanding at December

31,

2001. Comparatively, based on 2001 fuel usage, a

10

percent increase

in

fuel

prices would tlave resulted

in

an increase

in

fuel

expense

of

approximately $13.9 million, net of tledging instruments utilized during 2001.

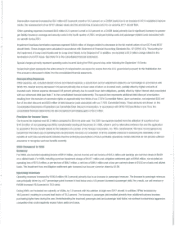

In

2001, we

entered into fuel-hedging contracts consisting of swap agreements to protect against increases in aircraft fuel prices. At December

31,

2001,

we

had

hedged approximately

30

percent

of

our projected fuel requirements for 2002, as compared to approximately

50

percent

of

our projected fuel require-

ments for the first quarter

of

2001 and 30 percent for the remainder

of

2001 at December

31,

2000.

On November 28, 2001, the credit rating

of

the counterparty to

all

of

our fuel-related hedges was downgraded, and the counterparty declared bankruptcy

on December

2,

2001. Due to the deterioration of the counterparty's creditworthiness, we no longer consider the financial contracts with the counter-

party to be highly effective

in

offsetting our risk related to changing fuel prices because

of

the consideration of the possibility that the counterparty

will default by failing to make contractually required payments as scheduled

in

the derivative instrument. As aresult, on November 28, 2001, hedge

accounting treatment was discontinued prospectively for our derivative contracts with this counterparty

in

accordance with SFAS 133. Gains and

losses previously deferred

in

"Accumulated other comprehensive loss" will continue to be reclassified to earnings as the hedged item affects earnings.

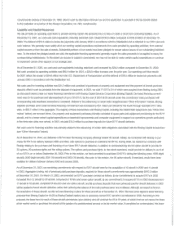

Beginning on November 28, 2001, changes

in

fair value

of

the derivative instruments have been marked to market through earnings. This resulted

in

acharge

of

$0.2 million, which

is

included

in

the amount presented as "SFAS 133 adjustment"

in

our Consolidated Statements of Operations.

Recent terminations

of

our aircraft fuel hedges

in

place as of December

31,

2001, are discussed

in

Note 16 to our consolidated financial statements.