Airtran 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 Airtran annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

additional

debt

discount

amortization resulting from the exercise

of

conversion rights

on

approximately

two-thirds

of

our

7.75% Convertible Notes.

Upon

conversion,

we

expensed S3.8 million

of

the

debt

discount

and

SO.5 million of

debt

issuance

costs

associated with

our

7.75% Convertible

Notes. A

summary

of

the

2001 special items, including where the

amounts

are recorded in

our

Consolidated

Statements

of

Operations, is listed below:

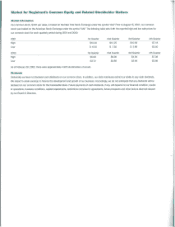

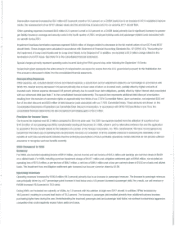

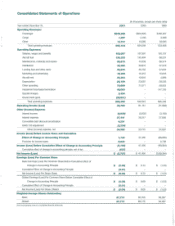

Description

Reduction

of

8737

and

OC-9

fleet values

and

lease termination charges (see

Note

13)

september

11th

special

charges

(see

Note

3)

Government

grant (see

Note

3)

Debt

discount

amortization (see

Note

7)

(In

millions)

Incomel(Expense)

Operating Nonoperating Total

$(46.1)

$-

$(46.1)

(2.5)

(25)

29.0

29.0

(4.3) (4.3)

$(19.6) $(4.3) $(23.9)

The

net

effect

of

these special

items

reduced

our

net

income

(loss) from S21.7million

to

$(2.8) million

and

reduced

our

earnings (loss) per

common

share from

$0.32

to

$(0.04).

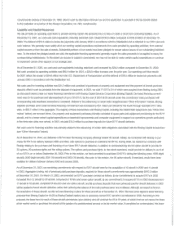

Operating

Revenues

Our

operating revenues for

the

year increased

$41.1

million (6.6 percent) primarily

due

to

an

increase in passenger revenues.

We

increased

our

capacity (available seat miles

or

ASMs)

by

11.6 percent

due

to

the continuation

of

our

fleet renewal

program

which resulted in the addition

of

14

8717

aircraft

and

the retirement

of

four

DC-9

and

four

8737

aircraft during the year.

Our

traffic (revenue passenger miles

or

RPMs) increased

by

9.5 percent

which

when

combined

with the increase

in

ASMs

resulted

in

a1.3 percentage point decline

in

our

passenger load factor.

Our

passenger yields also

declined

by

2.1

percent

to

14.39

cents

per RPM, which

in

conjunction with the higher traffic resulted in a

$43.7

million increase

in

our

passenger

revenues.

Cargo

revenues declined

by

$2.2

million during the year

due

to

the fact that

we

carried less mail for the U.S. Postal Service.

Our

financial results for the first eight

months

of 2001 were considerably different from those

of

the remainder

of

the year primarily

due

to

the impact

of

the

September

11

Events

on

our

passenger revenues. With the intent

of

providing a

more

meaningful understanding

of

this effect.

we

will further

discuss the 2001 results

in

two

time periods

as

follows: January through August,

and

September

through December.

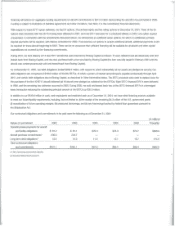

For the period

of

January through August 2001, the slowing

of

the U.S.

economy

resulted initially in greater price awareness

by

air travelers followed

by

an

overall decline in the

demand

for air travel. This increased price awareness

tended

to

benefit

low

fare airlines during this time period,

as

demon-

strated

by

our

revenue performance. Despite anearly 18 percent increase in

capacity

during this period,

we

experienced even higher levels

of

passen-

ger

demand

which resulted in

our

load

factor increasing

by

1.7 percentage

points

over

the

same

period

in

the

previous year.

Our

passenger yields also

increased by 3.2 percent

to

15

cents

per

RPM. This resulted

in

our

passenger revenues increasing

by

S95.5 million over the comparable period

in

2000.

Our

passenger revenues for

the

period

from

September

through

December

2001 were significantly affected

by

the

September

11

Events. In response

to

the

terrorist attacks,

the

Federal Aviation Administration (FAA) immediately issued aFederal

ground

stop

order

on

september

11th,

which

prohibited

all

civil aviation nights from operation within the national airspace

of

the United States.

The

U.S. airspace

was

not

reopened until

September

13th,

at

which

time

we

resumed operating aportion

of

our

pre-September 11th scheduled operations.

Once

flights resumed, passenger traffIC

and

yields

were significantly

lower

than

we

had experienced prior

to

september

11th.

In

an

effort

to

match

our

capacity

to

the reduced level

of

demand,

we

reduced

our

operations

10

levels similar

to

those

we

operated during the

same

period in

2000,

despite

the fact that

we

had

been successful in

growing

our

capacity

by

18 percent earlier

in

the

year.

In addition,

many

corporations curtailed their business travel

and

leisure travelers cancelled

or

postponed

vacations,

which

forced airlines

to

reduce airfares

in

an

attempt

to stimulate

demand.

Despite these actions,

our

traffic

dropped

by

over

11

percent

which resulted in

our

passenger load factor declining eight percentage

points

compared

to

the previous year. Passenger yields also suffered

during

this

period

and

declined nearly 15 percent year-over-year. This resulted in a$51.8 million,

or

25

percent, decline in passenger revenues

compared

to

the

same

time

period

in

2000.

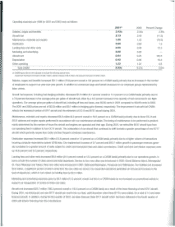

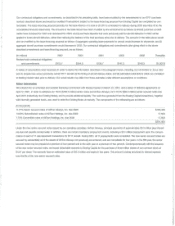

Operating

Expenses

Our

operating expenses increased

by

$86.5

million (15.9 percent)

on

an ASM increase

of

11.6 percent. Excluding the special items recognized during

2001 that are described above, our operating expenses increased

by

$66.9

million (12.3 percent). Operating

cost

per available seat mile (CASM),

excluding the special items, increased

0.6

percent from 9.27 cents

to

9.33

cents, primarily

due

to

the aircraft rent associated with the lease financing

of

agreater

number

of

aircraft

and

increased personnel costs.