Access America 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Access America annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Development prospects

In industrialised European countries where the recovery will be slow and uncertain with internal demand weakened by the rise in

unemployment, the Group will be continuing to improve its operational effi ciency by maintaining a higher quality standard of service while

continuing to explore new markets. In emerging countries, the development work on portfolios will be continued.

Major events occurring between the closure

date and the date of the consolidated accounts

There were no major event between the

closure date and the date of the consoli-

dated accounts.

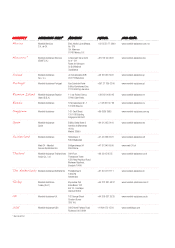

1. Information on capital

In application of article L. 233-13 of the

Code de commerce (French commercial

law), we remind you that, following the

merger mentioned above with MAG SAS,

the company’s shareholders are now:

• the Dutch branch of ACIF: 50%;

• Allianz Vie: 10.1%;

• Allianz IARD: 10.1%;

• Allianz France: 29.8%.

In accordance with the provisions in

article L. 225-211 of France’s Code de

commerce, on increasing employees’

holdings in the company, we inform you

that employees hold no shares in the

Company.

2. The company’s debt position

The Company had no debt at the year-end.

3. Delegation granted

by the Extraordinary

General Meeting

The Extraordinary General Meeting did

not grant any delegation of power rela-

tive to decisions or actions to increase

the capital.

4. Signifi cant events

since the year-end

Subsequent to the absorption by MASAS

of its shareholder, it has been decided to

alter the governance of the Company and

introduce a supervisory board and an

audit committee whose members are:

• Supervisory Board:

– Christof Mascher

– François Thomazeau

– Detlev Bremkamp

– Walter Gutberlet

– Manfred Knopf

• Audit Committee:

– Christof Mascher

– François Thomazeau

– Detlev Bremkamp

• Group debt: none

• Use of fi nancial instruments: none other than the cover instrument on Allianz Group share purchase options granted

to managers by the Group

• Risks: see notes to the consolidated accounts where risk management mechanisms are

described

• Information on environment issues: not applicable

• Research and development activity: none

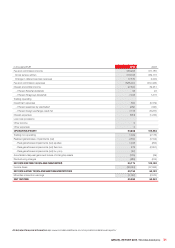

Other nancial and business indicators

ANNUAL REPORT 2009 / Mondial Assistance 29