eBay 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We believe that existing cash, cash equivalents and investments of approximately $5.0 billion, together with

cash generated from operations and cash available through our credit agreement, will be sufficient to fund our

operating activities, capital expenditures, stock repurchases and other obligations for the foreseeable future.

Commitments and Contingencies

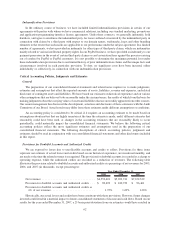

We have certain fixed contractual obligations and commitments that include future estimated payments.

Changes in our business needs, contractual cancellation provisions, fluctuating interest rates, and other factors may

result in actual payments differing from the estimates. We cannot provide certainty regarding the timing and

amounts of these payments. We have presented below a summary of the most significant assumptions used in our

determination of amounts presented in the tables, in order to assist in the review of this information within the

context of our consolidated financial position, results of operations, and cash flows. The following table sum-

marizes our fixed contractual obligations and commitments (in thousands):

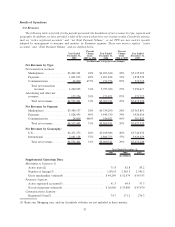

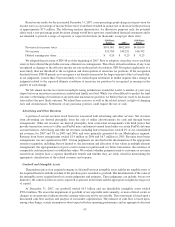

Payments Due By Year Ending December 31,

Operating

Leases

Purchase

Obligations Total

2008 ............................................ $ 64,870 $372,157 $437,027

2009 ............................................ 59,221 105,099 164,320

2010 ............................................ 45,960 58,786 104,746

2011 ............................................ 32,342 45,019 77,361

2012 ............................................ 27,940 42,563 70,503

Thereafter ........................................ 87,688 643 88,331

$318,021 $624,267 $942,288

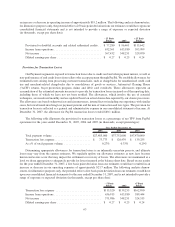

Operating lease amounts include minimum rental payments under our non-cancelable operating leases for

office facilities, as well as limited computer and office equipment that we utilize under lease arrangements. The

amounts presented are consistent with contractual terms and are not expected to differ significantly, unless a

substantial change in our headcount needs requires us to expand our occupied space or exit an office facility early.

Purchase obligation amounts include minimum purchase commitments for advertising, capital expenditures

(computer equipment, software applications, engineering development services, construction contracts) and other

goods and services that were entered into through our ordinary course of business. For those contractual

arrangements in which there are significant performance requirements, we have developed estimates to project

expected payment obligations. These estimates have been developed based upon historical trends, when available,

and our anticipated future obligations. Given the significance of such performance requirements within our

advertising and other arrangements, actual payments could differ significantly from these estimates.

The table above does not include liabilities related to unrecognized tax benefits under FASB Interpretation

No. 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”). As we are unable to reasonably predict the

timing of settlement of such FIN 48 liabilities, the table does not include $494.3 million of such non-current

liabilities recorded on our consolidated balance sheet as of December 31, 2007.

Off-Balance Sheet Arrangements

As of December 31, 2007, we had no off-balance sheet arrangements that have, or are reasonably likely to

have, a current or future material effect on our consolidated financial condition, results of operations, liquidity,

capital expenditures or capital resources. Customer funds held by PayPal as an agent or custodian on behalf of our

customers are not reflected in our consolidated balance sheets. These funds include funds on behalf of U.S. cus-

tomers that are deposited in bank accounts insured by the Federal Deposit Insurance Corporation and funds that

U.S. customers choose to invest in the PayPal Money Market Fund, which totaled approximately $1.8 billion and

$1.5 billion as of December 31, 2007 and 2006, respectively. The PayPal Money Market Fund is invested in a

portfolio managed by Barclays Global Fund Advisors.

61