eBay 2007 Annual Report Download - page 121

Download and view the complete annual report

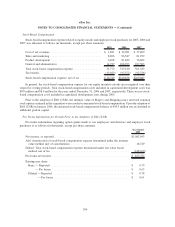

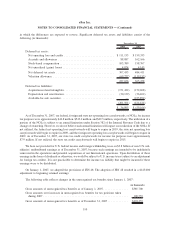

Please find page 121 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The total liabilities for unrecognized tax benefits, and the increase in these liabilities in 2007 relates primarily

to the allocations of revenue and costs among our global operations. Our liabilities for unrecognized tax benefits are

recorded as deferred and other tax liabilities, net in our consolidated balance sheet. If recognized, the portion of

liabilities for unrecognized tax benefits that would decrease our provision for income taxes and increase our net

income is $328.8 million. The impact on net income reflects the liabilities for unrecognized tax benefits net of

certain deferred tax assets and the federal tax benefit of state income tax items.

Over the next twelve months, our existing tax positions will continue to generate an increase in liabilities for

unrecognized tax benefits. We recognize interest and/or penalties related to uncertain tax positions in income tax

expense. The amount of interest and penalties net of tax benefits, accrued as of January 1, 2007 and December 31,

2007 was approximately $7.7 million and $16.3 million, respectively.

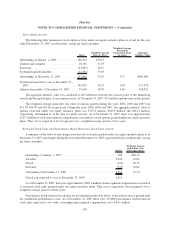

We are subject to taxation in the U.S. and various states and foreign jurisdictions. We are under examination by

certain tax authorities for the 2003 tax year. The material jurisdictions that are subject to potential examination by

tax authorities for tax years after 2002 primarily include the U.S., California, France, Germany, Switzerland, and

Singapore.

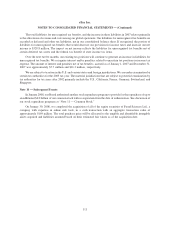

Note 14 — Subsequent Events:

In January 2008, our Board authorized another stock repurchase program to provide for the repurchase of up to

an additional $2.0 billion of our common stock with no expiration from the date of authorization. See discussion of

our stock repurchase programs at “Note 11 — Common Stock.”

On January 30, 2008, we completed the acquisition of all of the equity securities of Fraud Sciences Ltd., a

company with expertise in online risk tools, in a cash transaction with an aggregate transaction value of

approximately $169 million. The total purchase price will be allocated to the tangible and identifiable intangible

assets acquired and liabilities assumed based on their estimated fair values as of the acquisition date.

111

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)