eBay 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.adopting FAS 123(R), $84.8 million and $92.4 million of excess tax benefits for 2007 and 2006, respectively, have

been reported as a cash inflow from financing activities.

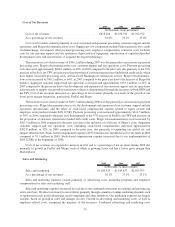

The net cash used in investing activities in 2007 was due primarily to cash paid for acquisitions and the

purchase of property and equipment, partially offset by cash generated by our net investment activity. The net cash

provided by investing activities in 2006 reflected the cash generated from our net investment activity offset by the

purchase of property and equipment. The net cash used in investing activities in 2005 was due primarily to cash paid

for acquisitions and the purchase of property and equipment, offset by cash generated by our net investment activity.

Purchases of property and equipment, net totaled $454.0 million in 2007, $515.4 million in 2006, and $338.3 million

in 2005 related mainly to purchases of computer equipment and software to support our site operations, customer

support and international expansion. Cash expended for acquisitions, net of cash acquired, totaled approximately

$863.6 million in 2007, $45.5 million in 2006, and $2.7 billion in 2005. In 2007, acquisition activity primarily

consisted of $530.3 million earn out payment related to our 2005 Skype acquisition and our 2007 acquisition of

StubHub. In 2006, we acquired Tradera.com. In 2005, acquisition activity primarily consisted of Rent.com, certain

international classifieds websites, Shopping.com, Skype and VeriSign’s payment gateway business. In 2008, we

expect to continue to purchase property and equipment and expect such purchases to total between 6.5% and 7.0%

of revenue. Also, we may acquire businesses with cash, which would impact our investing cash flows.

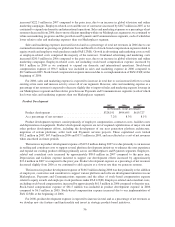

The net cash flows used in financing activities of $693.4 million in 2007 were due primarily to the repurchase

of approximately 44.6 million shares of our common stock for an aggregate purchase price of approximately

$1.5 billion, offset by the proceeds from stock option exercises totaling $507.0 million and $200.2 million of

proceeds from borrowings under our credit agreement. The net cash flows used in financing activities of $1.3 billion

in 2006 were due primarily to the repurchase of approximately 54.5 million shares of our common stock for an

aggregate purchase price of approximately $1.7 billion, offset by the proceeds from stock option exercises of

$313.5 million. The net cash flows provided by financing activities in 2005 were due primarily to proceeds from

stock option exercises of $599.8 million. Prior to 2006, we had not repurchased our common stock under a stock

repurchase program. Our future cash flows from equity awards are difficult to project as such amounts are a function

of our stock price, the number of options outstanding and the decisions by employees to exercise equity awards. In

general, we expect proceeds from stock option exercises to increase during periods in which our stock price has

increased relative to historical levels.

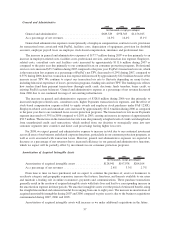

In July 2006, our Board authorized the repurchase of up to $2.0 billion of our common stock within two years

from the date of authorization. During 2006, we repurchased approximately 54.5 million shares of our common

stock at an average price of $30.56 per share for an aggregate purchase price of $1.7 billion. In January 2007, our

Board authorized, and we announced, an expansion of the stock repurchase program to provide for the repurchase of

up to an additional $2.0 billion of our common stock over the next two years. During 2007, we repurchased

approximately 44.6 million shares of our common stock at an average price of $33.42 per share for an aggregate

purchase price of $1.5 billion, under this stock repurchase program. In January 2008, our Board authorized, and we

announced, another stock repurchase program of up to $2.0 billion of our common stock, giving us the ability to

repurchase up to $2.85 billion of our common stock under our combined stock repurchase programs. Share

repurchases under our repurchase programs may take a variety of forms, including structured stock repurchase

programs and other derivative transactions. We expect to continue to repurchase our common stock in 2008, which

would reduce financing cash flows or increase financing cash usage.

The positive effect of exchange rates on cash and cash equivalents during 2007 and 2006 was due to the

weakening of the U.S. dollar against other foreign currencies, primarily the Euro. The negative effect of exchange

rates on cash and cash equivalents during 2005 was due to the strengthening of the U.S. dollar against other foreign

currencies, primarily the Euro.

In August 2007, we entered into an amendment to our 2006 credit agreement. The amendment agreement

increased the lender commitments and borrowing capacity under the 2006 credit agreement from its prior level of

$1.0 billion to $2.0 billion, maintained an option to increase borrowing capacity by an additional $1.0 billion (after

giving effect to the $1.0 billion increase described above) and extended the maturity date by an additional year to

November 7, 2012. As of December 31, 2007, $1.8 billion was available under the credit agreement.

60