eBay 2007 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

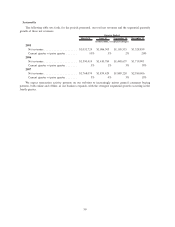

Impairment of Goodwill

2005 2006 2007

(in thousands, except percentages)

Impairment of goodwill ................................. $ — $ — $1,390,938

As a percentage of net revenues ........................... — — 18.1%

Impairment of goodwill was $1.4 billion for the year ended December 31, 2007. We conducted our annual

impairment test of goodwill as of August 31 in accordance with SFAS No. 142, “Goodwill and Other Intangible

Assets.” As a result of this test, we concluded that the carrying amount of our Communications reporting unit

exceeded its fair value and recorded an impairment loss of approximately $1.4 billion (including a $530.3 million

payment related to the earn out settlement agreement with certain former shareholders of Skype) during the year

ended December 31, 2007. The impairment resulted from an updated long-term financial outlook for the Skype

business developed as part of our strategic planning cycle conducted annually during our third quarter. Our

estimates of future operating results for our Communications reporting unit are for an early stage business with

limited financial history, as well as developing revenue models. These factors increase the risk of differences

between projected and actual performance that could impact future estimates of fair value of the Communications

reporting unit. See “Note 3 — Business Combinations, Goodwill and Intangible Assets” in the consolidated

financial statements included elsewhere in this report for further details. We have determined that there were no

events or circumstances from August 31 through December 31, 2007 that would indicate a further assessment was

necessary. We had no impairment charges in the years ended December 31, 2006 or 2005.

Interest and Other Income, Net

2005 2006 2007

(in thousands, except percentages)

Interest and other income, net .......................... $111,099 $130,017 $154,271

As a percentage of net revenues ........................ 2.4% 2.2% 2.0%

Interest and other income, net consists primarily of interest earned on cash, cash equivalents and investments as

well as foreign exchange transaction gains and losses, our portion of unconsolidated joint venture and minority

equity investment results and other miscellaneous transactions not related to our primary operations.

Interest and other income, net increased in 2007 as compared to the prior year due primarily to higher cash,

cash equivalents, and investments balances and higher interest rates, partially offset by losses from our portion of

unconsolidated joint ventures and minority equity investments. The weighted-average interest rate of our cash and

interest bearing investments portfolio increased to 4.2% in 2007 from 3.8% in 2006.

Our interest and other income, net increased in total and remained relatively constant as a percentage of net

revenues during 2006 as compared to the prior year, primarily as a result of increased interest income due to

increased cash, cash equivalents and investments balances and higher interest rates, offset by the lower cash

balances due to our stock repurchase activity in 2006. The weighted-average interest rate of our cash and interest

bearing investments portfolio increased to 3.8% in 2006 from 2.9% in 2005.

We expect that interest and other income, net, in 2008 will vary primarily based on future interest rates and the

level of invested assets, which will be impacted by the extent of our stock repurchase activity, as well as the results

of our portion of unconsolidated joint ventures and our minority equity investments.

Interest Expense

2005 2006 2007

(in thousands, except percentages)

Interest expense ........................................ $3,478 $5,916 $16,600

As a percentage of net revenues............................. 0.1% 0.1% 0.2%

Interest expense consists of interest charges on the amount drawn under our credit agreement and certain

accrued contingencies. The increase in interest expense during 2007 compared to the prior year is due primarily to

interest charges associated with our borrowings under our credit agreement. In 2008, interest expense may be

58