eBay 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

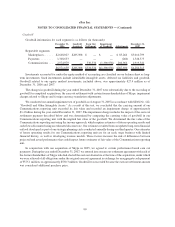

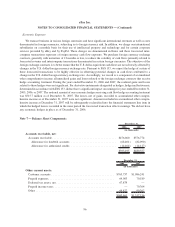

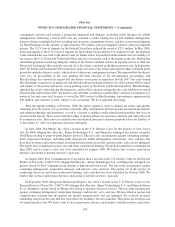

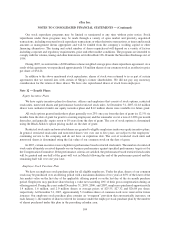

Gross

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

December 31, 2007

Short-term investments:

Restricted cash ......................... $17,401 $ 9 $ — $ 17,410

Corporate debt securities .................. 37,802 — (644) 37,158

Government and agency securities ........... 1,025 2 — 1,027

Time deposits and other ................... 22,428 — — 22,428

Equity instruments ....................... 8,507 589,734 — 598,241

$87,163 $589,745 $(644) $676,264

Long-term investments:

Restricted cash ......................... $ 8,852 $ — $ — $ 8,852

Corporate debt securities .................. 16,465 5 (8) 16,462

$25,317 $ 5 $ (8) $ 25,314

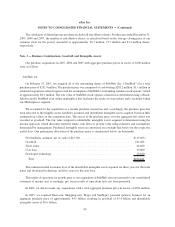

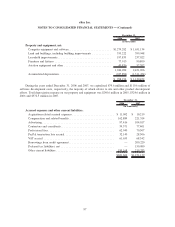

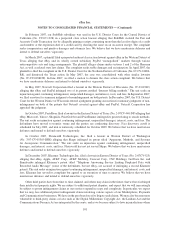

The following table summarizes the fair value and gross unrealized losses of our short-term and long-term

investments, aggregated by type of investment instrument and length of time that individual securities have been in

a continuous unrealized loss position, at December 31, 2007 (in thousands):

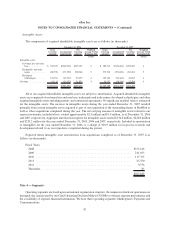

Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

Less than 12 Months 12 Months or Greater Total

Corporate debt

securities ........... $35,923 $(644) $5,022 $(8) $40,945 $(652)

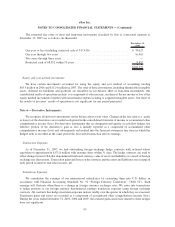

Our investment portfolio consists of both corporate and government securities that have a maximum maturity

of five years. The corporate and government securities that we invest in are generally deemed to be low risk, based

on their credit rating from the major rating agencies. The longer the duration of these securities, the more

susceptible they are to changes in market interest rates and bond yields. As interest rates increase, those securities

purchased at a lower yield show a mark-to-market unrealized loss. The unrealized losses are due primarily to

changes in ratings and interest rates. We expect to realize the full value of all these investments upon maturity or

sale. As of December 31, 2007, the losses on these securities have an average remaining duration of approximately

one month. Restricted cash is held primarily in money market funds and interest bearing accounts for letters of

credit related primarily to various lease arrangements.

Effective during 2007, we began to account for our investment in MercadoLibre as an available-for-sale

marketable equity security due to MercadoLibre’s initial public offering of its common stock in August of 2007. As

of December 31, 2007, our investment was recorded at fair value and reported as a short-term investment with

unrealized gains, net of tax, excluded from earnings and reported as a component of accumulated other compre-

hensive income.

94

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)