eBay 2007 Annual Report Download - page 59

Download and view the complete annual report

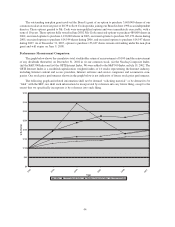

Please find page 59 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Marketplaces platforms. Revenue derived from our Merchant Services business increased by approximately 51% in

2007 compared to 2006 and represented approximately 42% of net TPV in 2007 compared to 35% in 2006.

Revenue generated by our Communications segment, Skype, increased 96% in 2007 as compared to 2006.

Revenue growth at Skype was due primarily to the growth in SkypeOut minutes driven by our expanding user base

and the broadening of our product offerings and various strategic relationships. Skype represents approximately 5%

of our total net revenue.

Our operating margin was 8% in 2007, which reflected the significant impact of the goodwill impairment

charge related to Skype of $1.4 billion, which represented 18% of net revenues. In 2006, our operating margin was

24%.

Our diluted earnings per share was $0.25 in 2007. The goodwill impairment charge related to Skype of

$1.4 billion reduced our diluted earnings per share by $1.01. In 2006 our diluted earnings per share was $0.79.

We generated operating cash flow of $2.6 billion in 2007, which allowed us to repurchase approximately

44.6 million shares of our common stock for approximately $1.5 billion. As of December 31, 2007, our cash and

cash equivalents balance was approximately $4.2 billion.

We expect that our business will continue to grow; however, our growth rate has declined over time and we

expect that to continue in 2008, primarily as a result of the following:

• we face challenges in the U.S., U.K. and Germany, which are our three largest markets, as growth of listings,

active users and GMV on the eBay.com platform in those countries has slowed. In January 2008, we

announced our plan to implement changes to our fee structure, seller incentives and standards and feedback

system, all of which may impact our Marketplaces revenue growth;

• consumer spending in our major markets, including the U.S., Germany and the U.K., is expected to be

weaker in 2008; and

• we anticipate that ecommerce growth as a whole will decelerate in 2008.

We believe that our operating margin percentage will be impacted negatively by the growth of our lower gross

margin businesses, primarily PayPal and Skype, which are growing faster than our Marketplaces business and

investment in buyer and seller initiatives, and may be affected by the other changes mentioned above. To partially

offset this trend, we intend to continue to improve operating productivity to keep our operating expenses growing at

a slower pace than revenue.

We announced another stock repurchase program in January 2008 for $2.0 billion, giving us the ability to

repurchase up to $2.85 billion of our common stock under our combined stock repurchase programs. Any

repurchases of our common stock under our combined stock repurchase programs may impact our liquidity.

In addition to the above, to the extent that the U.S. dollar fluctuates against foreign currencies, particularly the

Euro, British pound, Korean won and Australian Dollar, the translation of these foreign currency denominated

transactions into U.S. dollars will impact our consolidated net revenues and, to the extent that they are not hedged

successfully, our net income.

49