eBay 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

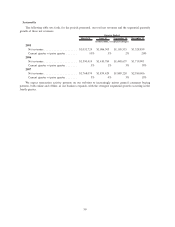

(1) Includes 47,481 shares of our common stock issuable pursuant to deferred stock units, or DSUs, under our 2003

Deferred Stock Unit Plan, and 8,833,633 shares of our common stock issuable pursuant to restricted stock units

under our 1998 Equity Incentive Plan and our 1999 Global Equity Incentive Plan. DSUs and restricted stock

units represent an unfunded, unsecured right to receive shares of eBay common stock (or, in the case of DSUs,

the equivalent value thereof in cash or property), and the value of DSUs and restricted stock units varies directly

with the price of eBay’s common stock.

(2) Because DSUs and restricted stock units do not have an exercise price, the 47,481 shares of our common stock

issuable pursuant to DSUs under our 2003 Deferred Stock Unit Plan and 8,833,633 shares of our common stock

issuable pursuant to restricted stock units under our 1998 Equity Incentive Plan and our 1999 Global Equity

Incentive Plan are not included in the calculation of weighted average exercise price.

(3) Includes 5,212,281 shares of our common stock remaining reserved for future issuance under our 1998

Employee Stock Purchase Plan, or the ESPP, as of December 31, 2007. Our ESPP contains an “evergreen”

provision that automatically increases, on each January 1, the number of securities reserved for issuance under

the ESPP by the number of shares purchased under the ESPP in the preceding calendar year, provided that the

aggregate number of shares reserved for issuance under the ESPP may not exceed 36,000,000 shares. As of

December 31, 2007, an aggregate amount of 11,772,941 shares had been purchased under the ESPP since its

inception. An aggregate amount of 1,987,719 shares was purchased under the ESPP in 2007, and the number of

securities available for future issuance under the ESPP was increased by that number on January 1, 2008,

bringing the total number of shares reserved for future issuance on January 1, 2008 to 7,200,000. None of our

other equity compensation plans has an “evergreen” provision.

(4) Does not include: (i) 6,350 shares of our common stock, with a weighted average exercise price of $1.26 per

share, to be issued upon exercise of outstanding options assumed by us under the Half.com, Inc. 1999 Equity

Compensation Plan; (ii) 11,489 shares of our common stock, with a weighted average exercise price of $0.77

per share, to be issued upon exercise of outstanding options assumed by us under the X.com Corporation 1999

Stock Plan; (iii) 294,544 shares of our common stock, with a weighted average exercise price of $10.29 per

share, to be issued upon exercise of outstanding options assumed by us under the PayPal, Inc. 2001 Equity

Incentive Plan; (iv) 85,875 shares of our common stock, with a weighted average exercise price of $10.24 per

share, to be issued upon exercise of outstanding options assumed by us under the Shopping.com Ltd. 2003

Omnibus Stock Option and Restricted Stock Incentive Plan; (v) 669,526 shares of our common stock, with a

weighted average exercise price of $36.03 per share, to be issued upon exercise of outstanding options assumed

by us under the Shopping.com Ltd. 2004 Equity Incentive Plan; (vi) 335,678 shares of our common stock, with

a weighted average exercise price of $4.15 per share, to be issued upon exercise of outstanding options assumed

by us under the Skype Technologies S.A. Stock Option Plan Rules; (vii) 364,267 shares of our common stock,

with a weighted average exercise price of $7.17 per share, to be issued upon exercise of outstanding options

assumed by us under the StubHub, Inc. 2000 Stock Plan; or (viii) 162,733 shares of our common stock, with a

weighted average exercise price of $0.93 per share, to be issued upon exercise of outstanding options assumed

by us under the StumbleUpon, Inc. 2006 Stock Plan. All of the options and related plans referenced above were

assumed by us in connection with acquisitions. We cannot make subsequent grants or awards of our equity

securities under any of these plans. Prior to each acquisition, the stockholders of the acquired company

approved the acquired company’s plan. Our stockholders, however, did not approve any of the plans in

connection with the acquisitions.

The only outstanding non-plan grant as of December 31, 2007 relates to an individual compensation

arrangement that was made prior to the initial public offering of our common stock in 1998. At the time of this

non-plan grant, members of our Board of Directors, or Board, and their affiliates beneficially owned in excess of

90% of our then outstanding equity and voting interests. This non-plan grant was initially disclosed in our initial

public offering prospectus filed with the SEC on September 25, 1998 under the headings “Management — Director

Compensation” and “— Compensation Arrangements.” Except as set forth below, the terms and conditions of this

non-plan grant are identical to the terms of options granted under our 1997 Stock Option Plan, a copy of which was

filed as an exhibit to our S-1 Registration Statement (No. 33-59097) filed in connection with our initial public

offering.

43