eBay 2004 Annual Report Download - page 76

Download and view the complete annual report

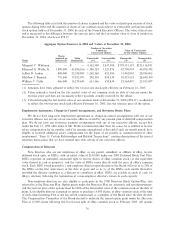

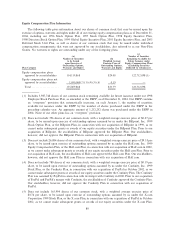

Please find page 76 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) All 2004 bonuses represent amounts paid in 2004 and 2005 for services rendered in 2004, all 2003

bonuses represent amounts paid in 2003 and 2004 for services rendered in 2003, and all 2002 bonuses

represent amounts paid in 2002 and 2003 for services rendered in 2002.

(3) Represents: (i) in the case of Ms. Whitman for 2004, personal use of eBay's corporate aircraft, valued at

the incremental cost of such use to the company ($229,145), and an additional $128,390 bonus granted

by the Compensation Committee in 2005 to cover any income taxes relating to such aircraft use; (ii) in

the case of Ms. Whitman for 2003, personal use of eBay's corporate aircraft, valued at the incremental

cost of such use to the company ($307,496), and an additional $70,000 bonus granted by the

Compensation Committee in 2004 to cover any income taxes relating to such aircraft use; (iii) in the

case of Ms. Whitman for 2002, her personal use of eBay's corporate aircraft ($171,693), valued at the

incremental cost of such use to the company, and of a corporate aircraft from an unaÇliated third-party

vendor, which is valued at actual invoiced amounts ($74,961); and an additional $90,000 bonus granted

by the Compensation Committee in 2003 to cover any income taxes relating to such aircraft use; (iv) in

the case of Mr. Webb for 2004, personal use of eBay's corporate aircraft, valued at the incremental cost

of such use to the company ($28,070), and an additional $7,265 bonus granted by the Compensation

Committee in 2005 to cover any income taxes relating to such aircraft use; (v) in the case of

Mr. Bannick for 2002, costs associated with family transportation while Mr. Bannick worked out of our

European oÇces during the summer of 2002; and (vi) in the case of Mr. Cobb for 2004, personal use of

eBay's corporate aircraft, valued at the incremental cost of such use to the company.

Prior to 2004, eBay calculated the cost of the personal use of its corporate aircraft using the Standard

Industrial Fare Level (SIFL) tables prescribed under applicable IRS regulations. Beginning in 2004,

eBay calculated the value of the personal use of its corporate aircraft by estimating the incremental cost

to the company of such use. The calculation of incremental cost is based on the weighted average cost of

fuel, maintenance expenses, parts and supplies, landing fees, ground services, catering and crew expenses

associated with such use. Had eBay used the IRS's SIFL tables to calculate the value of the personal

use of its corporate aircraft by Ms. Whitman, Mr. Webb, and Mr. Cobb in 2004, such use would have

been valued at $154,267, $13,050, and $7,070, respectively. Because eBay has determined that this

incremental cost methodology produces generally higher amounts than use of the SIFL calculation

method, the incremental cost methodology has also been used to calculate the value of personal use of

corporate aircraft by Ms. Whitman for 2003 and 2002. Prior annual reports and proxy statements

reÖected the value of Ms. Whitman's personal use of corporate aircraft in 2003 and 2002 using the SIFL

calculation method, and valued such use at $115,857 and $58,101, respectively.

(4) Amounts have been adjusted to reÖect all prior stock splits, including eBay's two-for-one stock split that

occurred on February 16, 2005.

(5) Represents, in the case of each of the Named Executive OÇcers, insurance premiums we paid with

respect to group life insurance for their beneÑt and matching contributions under our 401(k) Plan

(subject to the maximum of $1,500 per annum).

(6) Represents amounts paid to Ms. Whitman under eBay's Management Incentive Plan.

(7) Represents (i) for 2004, $726,279 paid under eBay's Management Incentive Plan and $1,154,000 paid

under Mr. Webb's special retention plan; (ii) for 2003, $620,501 paid under eBay's Management

Incentive Plan and $646,100 paid under Mr. Webb's special retention plan; and (iii) for 2002, $387,254

paid under eBay's Management Incentive Plan and $449,900 paid under Mr. Webb's special retention

plan. See ""Item 13: Certain Relationships and Related Transactions.''

(8) Represents (i) for 2004, $462,948 for 2004 paid under eBay's Management Incentive Plan, $472,025

under Mr. Jordan's special retention plans and an additional $2,065 bonus granted by the Compensation

Committee in 2005; (ii) for 2003, $361,505 for 2003 paid under eBay's Management Incentive Plan and

$497,288 under Mr. Jordan's special retention plans; and (iii) for 2002, $202,212 paid under eBay's

Management Incentive Plan, $522,550 paid under Mr. Jordan's special retention plans and $15,000 paid

pursuant to our discretionary reward program. See ""Item 13: Certain Relationships and Related

Transactions.''

74