eBay 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

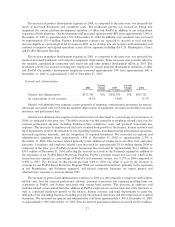

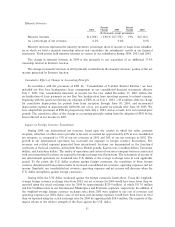

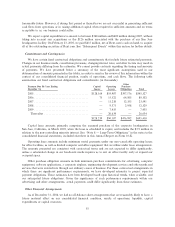

Provisions for Doubtful Accounts and Authorized Credits

Our U.S. Marketplace and International Marketplace segments are exposed to losses due to uncollectible

accounts and credits to sellers. Provisions for these items represent our estimate of actual losses and credits

based on our historical experience, are monitored monthly, and are made at the time the related revenue is

recognized. The provision for doubtful accounts is recorded as a charge to operating expense, while the

authorized credits are recorded as a reduction of revenues. The following table illustrates the provision related

to doubtful accounts and authorized credits as a percentage of net revenues for 2002, 2003, and 2004 (in

thousands, except percentages).

Years Ended December 31,

2002 2003 2004

Net revenues from the U.S. and International

Marketplace segments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $1,118,732 $1,727,474 $2,573,607

Provision for doubtful accounts and authorized credits ÏÏ $ 25,455 $ 46,049 $ 90,942

Provision for doubtful accounts and authorized credits

as a % of net revenues from the U.S. and

International Marketplace segments ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2.28% 2.67% 3.53%

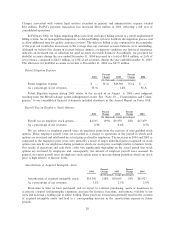

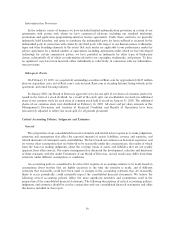

Historically, our actual losses and credits have been consistent with these provisions. However, future

changes in trends could result in a material impact to future consolidated statements of income and cash Öows.

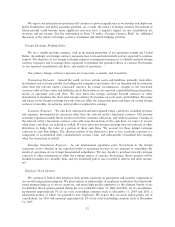

Based on our results for the year ended December 31, 2004, a 25 basis point deviation from our estimates

would have resulted in an increase or decrease in operating income of approximately $6.4 million. The

following analysis demonstrates, for illustrative purposes only, the potential eÅect a 25 basis point deviation

from our estimates would have upon our consolidated Ñnancial statements and is not intended to provide a

range of exposure or expected deviation (in thousands, except per share data):

Ó25 Basis °25 Basis

Points 2004 Points

Income from operating impact related to doubtful

accounts and authorized credits ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 84,508 $ 90,942 $ 97,376

Income from operations ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,065,676 1,059,242 1,052,808

Net incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 784,657 778,223 771,789

Diluted earnings per share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.57 $ 0.57 $ 0.56

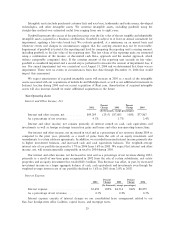

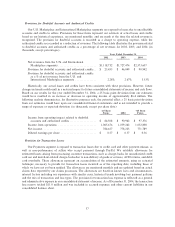

Provision for Transaction Losses

Our Payments segment is exposed to transaction losses due to credit card and other payment misuse, as

well as non-performance of sellers who accept payment through PayPal. We establish allowances for

estimated losses arising from processing customer transactions, such as charge-backs for unauthorized credit

card use and merchant-related charge-backs due to non-delivery of goods or services, ACH returns, and debit

card overdrafts. These allowances represent an accumulation of the estimated amounts, using an actuarial

technique, necessary to provide for transaction losses incurred as of the reporting date, including those of

which we have not yet been notiÑed. The allowances are monitored monthly and are updated based on actual

claims data reported by our claims processors. The allowances are based on known facts and circumstances,

internal factors including our experience with similar cases, historical trends involving loss payment patterns

and the mix of transaction and loss types. The provision for transaction loss expense is reÖected as a general

and administrative expense in our consolidated statement of income. As of December 31, 2004, the transaction

loss reserve totaled $11.0 million and was included in accrued expenses and other current liabilities in our

consolidated balance sheet.

37