eBay 2004 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

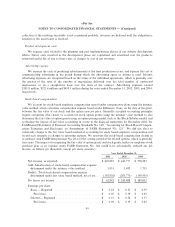

Intangible Assets

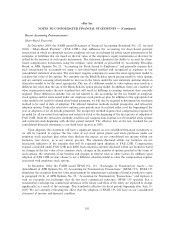

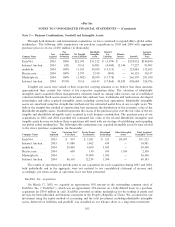

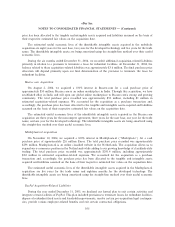

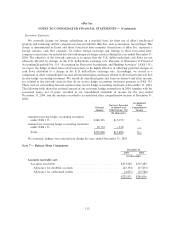

The components of acquired identiÑable intangible assets are as follows (in thousands):

December 31, 2003 December 31, 2004

Gross Net Weighted Gross Net Weighted

Carrying Accumulated Carrying Average Useful Carrying Accumulated Carrying Average Useful

Amount Amortization Amount Economic Life Amount Amortization Amount Economic Life

(Years) (Years)

Intangible assets:

Customer lists

and user baseÏÏ $223,158 $(42,093) $181,065 7 $300,929 $ (80,097) $220,832 7

Trademarks and

trade names ÏÏÏ 75,269 (13,992) 61,277 7 139,239 (30,811) 108,428 6

Developed

technologies ÏÏÏ 30,396 (16,147) 14,249 3 40,686 (28,488) 12,198 3

All otherÏÏÏÏÏÏÏÏ 19,605 (2,139) 17,466 5 33,895 (7,534) 26,361 4

$348,428 $(74,371) $274,057 $514,749 $(146,930) $367,819

All of our acquired identiÑable intangible assets are subject to amortization. Acquired identiÑable

intangible assets are comprised of customer lists and user base, trademarks and trade names, developed

technologies, and other acquired intangible assets including patents and contractual agreements. No signiÑ-

cant residual value is estimated for the intangible assets. The increase in intangible assets during the year

ended December 31, 2004 resulted primarily from an increase in our ownership in Internet Auction totaling

approximately $60.1 million, certain intangible assets acquired as part of our acquisition of the outstanding

shares of Marktplaats and mobile.de totaling approximately $38.5 million and $30.5 million, respectively, as

well as our acquisition of an equity investment, as noted in ""Note 5 Ì Investments'' of these consolidated

Ñnancial statements. As of December 31, 2004, the net carrying amount of intangible assets related to our

equity investment totaled approximately $4.9 million. Aggregate amortization expense for intangible assets

totaled $16.3 million, $53.2 million and $70.2 million for the years ended December 31, 2002, 2003 and 2004,

respectively.

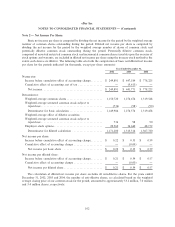

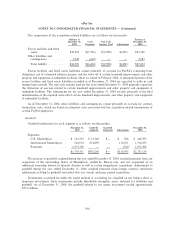

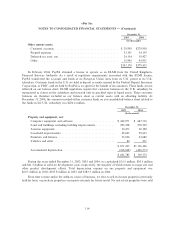

As of December 31, 2004, expected future intangible asset amortization is as follows (in thousands):

Fiscal Years:

2005 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 86,650

2006 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 73,027

2007 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 67,177

2008 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 64,986

2009 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 49,307

Thereafter ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 26,672

367,819

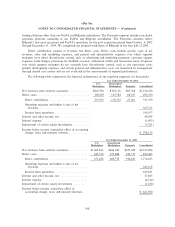

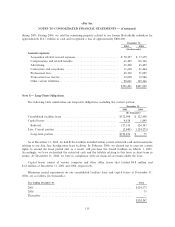

Note 4 Ì Segments:

Reporting segments are based upon our internal organization structure, the manner in which our

operations are managed, the criteria used by our chief operating decision-maker to evaluate segment

performance, the availability of separate Ñnancial information, and overall materiality considerations.

The U.S. Marketplace segment includes U.S. online marketplace trading platforms other than our PayPal

and Billpoint subsidiaries. The International Marketplace segment includes our international online marketplace

107