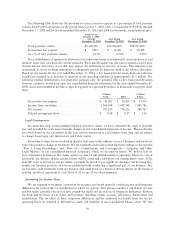

eBay 2004 Annual Report Download - page 42

Download and view the complete annual report

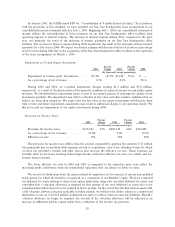

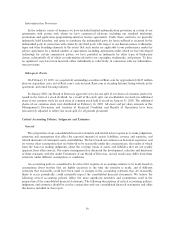

Please find page 42 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.revenue recognition, including, but not limited to, the assessment and allocation of fair values in multiple

element arrangements, the appropriateness of gross or net revenue recognition and, for barter transactions, the

existence of comparable cash transactions to establish fair values. Our advertising and other non-transaction

net revenues may be aÅected by the Ñnancial condition of the parties with whom we have these relationships

and by the success of online services and promotions in general. Unlike our transaction revenues, advertising

and other non-transaction net revenues are derived from a relatively concentrated customer base.

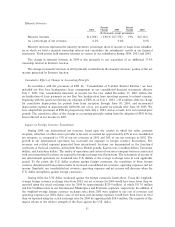

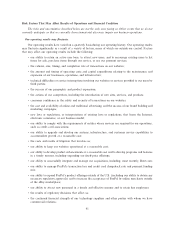

Business Combinations

In accordance with the provisions of SFAS 141, the purchase price of an acquired company is allocated

between intangible assets and the net tangible assets of the acquired business with the residual of the purchase

price recorded as goodwill. The determination of the value of the intangible assets acquired involves certain

judgments and estimates. These judgments can include, but are not limited to, the cash Öows that an asset is

expected to generate in the future and the appropriate weighted average cost of capital.

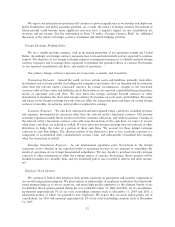

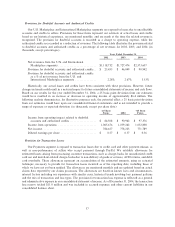

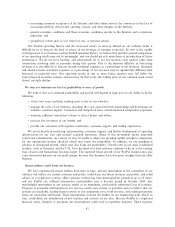

At December 31, 2004 our goodwill totaled $2.7 billion and our identiÑable intangible assets totaled

$362.9 million. In accordance with the provisions of SFAS 142, we assess the impairment of goodwill and

identiÑable intangible assets of our reportable units annually, or more often if events or changes in

circumstances indicate that the carrying value may not be recoverable. This assessment is based upon a

discounted cash Öow analysis and analysis of our market capitalization. The estimate of cash Öow is based

upon, among other things, certain assumptions about expected future operating performance and an

appropriate discount rate determined by our management. Our estimates of discounted cash Öows may diÅer

from actual cash Öows due to, among other things, economic conditions, changes to its business model or

changes in operating performance. SigniÑcant diÅerences between these estimates and actual cash Öows could

materially aÅect our future Ñnancial results. We completed our annual goodwill impairment test as of

August 31, 2004 and determined that no adjustment to the carrying value of goodwill for any of our reportable

units was required. We have determined that no events have occurred from that date through December 31,

2004 that would require an updated analysis.

40