eBay 2004 Annual Report Download - page 49

Download and view the complete annual report

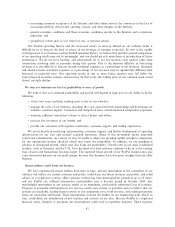

Please find page 49 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We continue to work with the relevant tax authorities and legislators to clarify eBay's obligations under

new and emerging laws and regulations. Passage of new legislation and the imposition of additional tax

requirements could harm eBay sellers and our business. There have been, and will continue to be, substantial

ongoing costs associated with complying with the various indirect tax requirements in the numerous markets

in which eBay conducts or will conduct business.

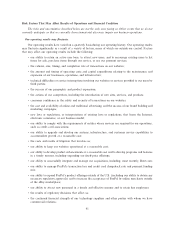

Fraudulent activities on our websites and disputes between users of our services may harm our business.

PayPal faces signiÑcant risks of loss due to fraud and disputes between senders and recipients, including:

‚ merchant fraud and other disputes over the quality of goods and services;

‚ unauthorized use of credit card and bank account information and identity theft;

‚ the need to provide eÅective customer support to process disputes between senders and recipients;

‚ potential breaches of system security;

‚ potential employee fraud; and

‚ use of PayPal's system by customers to make or accept payment for illegal or improper purposes.

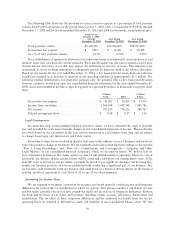

For the year ended December 31, 2004, PayPal's transaction loss expense totaled $50.5 million,

representing 0.27% of PayPal's total payment volume. Failure to deal eÅectively with fraudulent transactions

and customer disputes would increase PayPal's loss rate and harm its business.

PayPal's highly automated and liquid payment service makes PayPal an attractive target for fraud. In

conÑguring its service, PayPal faces an inherent trade-oÅ between customer convenience and security. Identity

thieves and those committing fraud using stolen credit card or bank account numbers can potentially steal

large amounts of money from businesses such as PayPal. We believe that several of PayPal's current and

former competitors in the electronic payments business have gone out of business or signiÑcantly restricted

their businesses largely due to losses from this type of fraud. We expect that technically knowledgeable

criminals will continue to attempt to circumvent PayPal's anti-fraud systems. In addition, PayPal's service

could be subject to employee fraud or other internal security breaches, and PayPal would be required to

reimburse customers for any funds stolen as a result of such breaches.

PayPal incurs substantial losses from merchant fraud, including claims from customers that merchants

have not performed or that their goods or services do not match the merchant's description. PayPal also incurs

losses from claims that the customer did not authorize the purchase, from erroneous transmissions and from

customers who have closed bank accounts or have insuÇcient funds in them to satisfy payments. In addition to

the direct costs of such losses, if they are related to credit card transactions and become excessive they could

result in PayPal losing the right to accept credit cards for payment. If PayPal were unable to accept credit

cards, the velocity of trade on eBay could decrease, in which case our business would further suÅer. PayPal

has been assessed substantial Ñnes for excess chargebacks in the past, and excessive chargebacks may arise in

the future. PayPal has taken measures to detect and reduce the risk of fraud, but these measures may not be

eÅective. If these measures do not succeed, our business will suÅer.

In October 2003, PayPal launched a buyer protection program that refunds to buyers up to $500 in

certain eBay transactions if they do not receive the goods they purchased or if the goods diÅer signiÑcantly

from what was described by the seller. In November 2004, PayPal increased the amount of protection

available under its buyer protection program to $1,000. If PayPal makes such a refund, it seeks to collect

reimbursement from the seller, but may not be able to receive any funds from the seller. The PayPal buyer

protection program has increased PayPal's loss rate and could cause future Öuctuations.

eBay faces similar risks to those of PayPal with respect to fraudulent activities, although eBay's risks may

to some extent be less signiÑcant. eBay periodically receives complaints from users who may not have received

the goods that they had purchased. In some cases individuals have been arrested and convicted for fraudulent

activities using our websites. eBay also receives complaints from sellers who have not received payment for the

goods that a buyer had contracted to purchase. Non-payment may occur because of miscommunication,

because a buyer has changed his or her mind and decided not to honor the contract to purchase the item, or

because the buyer bid on the item maliciously, in order to harm either the seller or eBay. In some European

47