eBay 2004 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

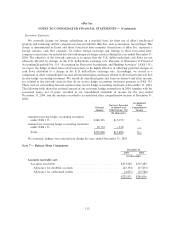

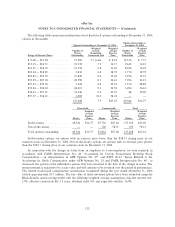

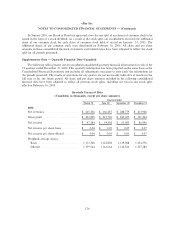

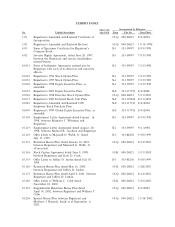

The following table summarizes information about Ñxed stock options outstanding at December 31, 2004

(shares in thousands):

Options Exercisable at

Options Outstanding at December 31, 2004 December 31, 2004

Weighted Weighted Weighted

Number of Average Average Number of Average

Shares Remaining Exercise Shares Exercise

Range of Exercise Prices Outstanding Contractual Life Price Exercisable Price

$ 0.08 Ì $13.24 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,990 5.7 years $ 8.21 12,514 $ 7.57

$13.25 Ì $14.51 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 21,332 7.3 14.17 9,632 14.21

$14.51 Ì $18.10 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,254 6.8 16.06 8,426 16.03

$18.24 Ì $18.85 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,836 6.8 18.70 1,770 18.72

$18.85 Ì $19.39 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 15,842 8.0 19.38 5,256 19.35

$19.39 Ì $27.38 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,590 8.1 24.61 7,056 24.12

$27.43 Ì $33.40 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 5,624 8.8 29.14 1,150 28.80

$33.46 Ì $34.62 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 24,412 9.2 34.58 3,494 34.61

$34.63 Ì $57.21 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 14,246 9.6 43.91 48 39.20

$57.37 Ì $58.21 ÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,082 10.0 58.03 Ì Ì

137,208 7.9 $23.63 49,346 $16.77

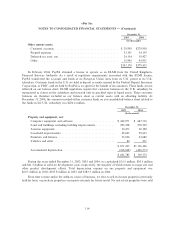

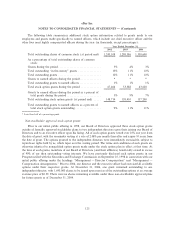

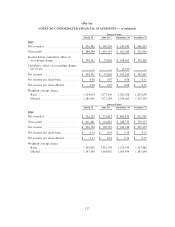

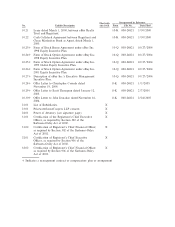

Exercisable Unexercisable Total

Weighted Weighted Weighted

Average Average Average

Exercise Exercise Exercise

Shares Price Shares Price Shares Price

In-the-money ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 49,346 $16.77 87,756 $27.44 137,102 $23.60

Out-of-the-money ÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì Ì 106 58.21 106 58.21

Total options outstanding ÏÏÏÏÏÏÏ 49,346 $16.77 87,862 $27.48 137,208 $23.63

In-the-money options are options with an exercise price lower than the $58.17 closing price of our

common stock on December 31, 2004. Out-of-the-money options are options with an exercise price greater

than the $58.17 closing price of our common stock on December 31, 2004.

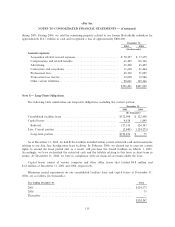

In connection with the change in status from an employee to a non-employee, we were required, in

accordance with FASB Interpretation No. 44 ""Accounting for Certain Transactions Involving Stock

Compensation Ì an interpretation of APB Opinion No. 25'' and EITF 00-23 ""Issues Related to the

Accounting for Stock Compensation under APB Opinion No. 25 and FASB Interpretation No. 44'', to

remeasure the portion of the individual's options that were unvested at the date of the change in status. The

remeasurement is required to be at fair value and will continue to be revalued over the period of performance.

The related stock-based compensation amortization recognized during the year ended December 31, 2004

totaled approximately $3.7 million. The fair value of these unvested options have been estimated using the

Black-Scholes option pricing model with the following weighted average assumptions: risk-free interest rate,

2.9%; eÅective contractual life 3.5 years; dividend yield, 0%; and expected volatility, 36.0%.

122