eBay 2004 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

eBay Inc.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

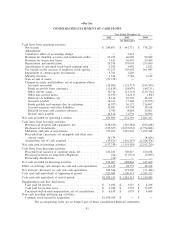

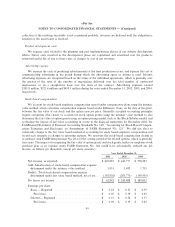

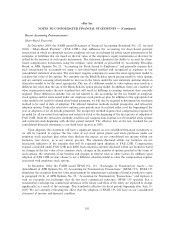

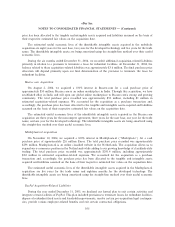

Note 2 Ì Net Income Per Share:

Basic net income per share is computed by dividing the net income for the period by the weighted average

number of common shares outstanding during the period. Diluted net income per share is computed by

dividing the net income for the period by the weighted average number of shares of common stock and

potentially dilutive common stock outstanding during the period. Potentially dilutive common stock,

composed of unvested restricted common stock and incremental common shares issuable upon the exercise of

stock options and warrants, are included in diluted net income per share using the treasury stock method to the

extent such shares are dilutive. The following table sets forth the computation of basic and diluted net income

per share for the periods indicated (in thousands, except per share amounts):

Year Ended December 31,

2002 2003 2004

Numerator:

Income before cumulative eÅect of accounting changeÏÏÏÏÏÏÏÏ $ 249,891 $ 447,184 $ 778,223

Cumulative eÅect of accounting, net of tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (5,413) Ì

Net incomeÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 249,891 $ 441,771 $ 778,223

Denominator:

Weighted average common shares ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,150,720 1,276,674 1,319,548

Weighted average unvested common stock subject to

repurchaseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ (736) (98) (90)

Denominator for basic calculation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,149,984 1,276,576 1,319,458

Weighted average eÅect of dilutive securities:

Weighted average unvested common stock subject to

repurchaseÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 736 98 90

Employee stock optionsÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 20,560 36,640 48,172

Denominator for diluted calculation ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,171,280 1,313,314 1,367,720

Net income per share:

Income before cumulative eÅect of accounting changeÏÏÏÏÏÏÏÏ $ 0.22 $ 0.35 $ 0.59

Cumulative eÅect of accounting change ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (0.00) Ì

Net income per basic share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.22 $ 0.35 $ 0.59

Net income per diluted share:

Income before cumulative eÅect of accounting changeÏÏÏÏÏÏÏÏ $ 0.21 $ 0.34 $ 0.57

Cumulative eÅect of accounting change ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì (0.00) Ì

Net income per diluted share ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.21 $ 0.34 $ 0.57

The calculation of diluted net income per share excludes all anti-dilutive shares. For the years ended

December 31, 2002, 2003 and 2004, the number of anti-dilutive shares, as calculated based on the weighted

average closing price of our common stock for the period, amounted to approximately 53.2 million, 7.0 million

and 3.4 million shares, respectively.

102