eBay 2004 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2004 eBay annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.eBay Inc.

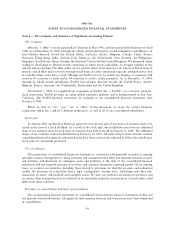

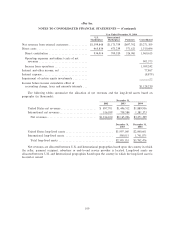

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

Recent Accounting Pronouncements

Share-Based Payments

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123 (revised

2004), ""Share-Based Payment'' (FAS 123R), that addresses the accounting for share-based payment

transactions in which an enterprise receives employee services in exchange for either equity instruments of the

enterprise or liabilities that are based on the fair value of the enterprise's equity instruments or that may be

settled by the issuance of such equity instruments. The statement eliminates the ability to account for share-

based compensation transactions using the intrinsic value method as prescribed by Accounting Principles

Board, or APB, Opinion No. 25, ""Accounting for Stock Issued to Employees,'' and generally requires that

such transactions be accounted for using a fair-value-based method and recognized as expenses in our

consolidated statement of income. The statement requires companies to assess the most appropriate model to

calculate the value of the options. We currently use the Black-Scholes option pricing model to value options

and are currently assessing which model we may use in the future under the new statement and may deem an

alternative model to be the most appropriate. The use of a diÅerent model to value options may result in a

diÅerent fair value than the use of the Black-Scholes option pricing model. In addition, there are a number of

other requirements under the new standard that will result in diÅering accounting treatment than currently

required. These diÅerences include, but are not limited to, the accounting for the tax beneÑt on employee

stock options and for stock issued under our employee stock purchase plan. In addition to the appropriate fair

value model to be used for valuing share-based payments, we will also be required to determine the transition

method to be used at date of adoption. The allowed transition methods include prospective and retroactive

adoption options. Under the retroactive options, prior periods may be restated either as of the beginning of the

year of adoption or for all periods presented. The prospective method requires that compensation expense be

recorded for all unvested stock options and restricted stock at the beginning of the Ñrst quarter of adoption of

FAS 123R, while the retroactive methods would record compensation expense for all unvested stock options

and restricted stock beginning with the Ñrst period restated. The eÅective date of the new standard for our

consolidated Ñnancial statements is our third Ñscal quarter in 2005.

Upon adoption, this statement will have a signiÑcant impact on our consolidated Ñnancial statements as

we will be required to expense the fair value of our stock option grants and stock purchases under our

employee stock purchase plan rather than disclose the impact on our consolidated net income within our

footnotes (see above), as is our current practice. The amounts disclosed within our footnotes are not

necessarily indicative of the amounts that will be expensed upon adoption of FAS 123R. Compensation

expense calculated under FAS 123R may diÅer from amounts currently disclosed within our footnotes based

on changes in the fair value of our common stock, changes in the number of options granted or the terms of

such options, the treatment of tax beneÑts and changes in interest rates or other factors. In addition, upon

adoption of FAS 123R we may choose to use a diÅerent valuation model to value the compensation expense

associated with employee stock options.

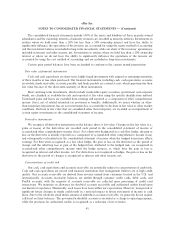

In December 2004, the FASB issued SFAS No. 153, ""Exchanges of Nonmonetary Assets Ì An

Amendment of APB Opinion No. 29, Accounting for Nonmonetary Transactions'' (SFAS 153). SFAS 153

eliminates the exception from fair value measurement for nonmonetary exchanges of similar productive assets

in paragraph 21(b) of APB Opinion No. 29, ""Accounting for Nonmonetary Transactions,'' and replaces it

with an exception for exchanges that do not have commercial substance. SFAS 153 speciÑes that a

nonmonetary exchange has commercial substance if the future cash Öows of the entity are expected to change

signiÑcantly as a result of the exchange. This standard is eÅective for Ñscal periods beginning after June 15,

2005. We are currently evaluating the eÅect that the adoption of SFAS 153 will have on our consolidated

statement of income and Ñnancial condition.

101