Whirlpool 2009 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2009 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

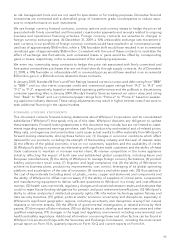

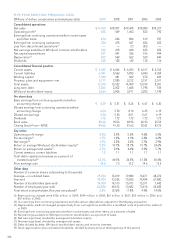

FI V E -Y E A R S E LEC T E D F I N A N C I A L DATA

(Millions of dollars, except share and employee data) 2009 2008 2007 2006 2005

Consolidated operations

Net sales $ 17,099 $ 18,907 $ 19,408 $ 18,080 $ 14,317

Operating profit(1) 688 549 1,063 823 792

Earnings from continuing operations before income taxes

and other items 294 246 804 619 597

Earnings from continuing operations 354 418 647 486 422

Loss from discontinued operations(2) —— (7) (53) —

Net earnings available to Whirlpool common stockholders 328 418 640 433 422

Net capital expenditures 541 547 536 576 494

Depreciation(3) 497 569 562 520 440

Dividends 128 128 134 130 116

Consolidated financial position

Current assets $ 7,025 $ 6,044 $ 6,555 $ 6,517 $ 4,763

Current liabilities 5,941 5,563 5,893 6,043 4,354

Working capital 1,084 481 662 474 409

Property, plant and equipment—net 3,117 2,985 3,212 3,157 2,511

Total assets 15,094 13,532 14,009 13,759 8,301

Long-term debt 2,502 2,002 1,668 1,798 745

Whirlpool stockholders’ equity 3,664 3,006 3,911 3,283 1,745

Per share data

Basic earnings from continuing operations before

accounting change $ 4.39 $ 5.57 $ 8.24 $ 6.47 $ 6.30

Diluted earnings from continuing operations before

accounting change 4.34 5.50 8.10 6.35 6.19

Diluted net earnings 4.34 5.50 8.01 5.67 6.19

Dividends 1.72 1.72 1.72 1.72 1.72

Book value 48.48 39.54 48.96 42.93 25.54

Closing Stock Price—NYSE 80.66 41.35 81.63 83.02 83.76

Key ratios

Operating profit margin 4.0% 2.9% 5.5% 4.6% 5.5%

Pre-tax margin(4) 1.7% 1.3% 4.1% 3.4% 4.2%

Net margin(5) 1.9% 2.2% 3.3% 2.7% 2.9%

Return on average Whirlpool stockholders’ equity(6) 9.8% 10.7% 18.1% 15.7% 24.6%

Return on average total assets(7) 2.3% 3.0% 4.6% 3.9% 5.1%

Current assets to current liabilities 1.2 1.1 1.1 1.1 1.1

Total debt—appliance business as a percent of

invested capital(8) 43.6% 46.0% 34.5% 41.2% 40.4%

Price earnings ratio 18.6 7.5 10.2 14.6 13.5

Other data

Number of common shares outstanding (in thousands):

Average—on a diluted basis 75,584 76,019 79,880 76,471 68,272

Year-end 74,704 73,536 75,835 78,484 67,880

Number of stockholders (year-end) 14,930 14,515 15,011 15,311 7,442

Number of employees (year-end) 66,884 69,612 73,682 73,416 65,682

Total return to shareholders (five year annualized)(9) 5.8% (8.5)% 11.8% 4.9% 14.5%

(1) Restructuring charges were $126 million in 2009, $149 million in 2008, $61 million in 2007, $55 million in 2006 and

$57 million in 2005.

(2) Our earnings from continuing operations exclude certain dispositions adjacent to the Maytag acquisition.

(3) Depreciation method changed prospectively from a straight-line method to a modified units of production method

in 2009.

(4) Earnings from continuing operations before income taxes and other items, as a percent of sales.

(5) Net earnings available to Whirlpool common stockholders, as a percent of sales.

(6) Net earnings (loss), divided by average stockholders’ equity.

(7) Net earnings (loss), divided by average total assets.

(8) Debt divided by debt, Whirlpool stockholders’ equity and minority interests.

(9) Stock appreciation plus reinvested dividends, divided by share price at the beginning of the period.

104