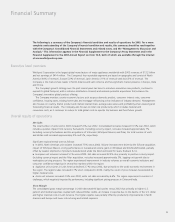

Whirlpool 2003 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2003 Whirlpool annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2000 1999 1998 1997 1996 1995 1994 1993

$10,325 $10,511 $10,323 $8,617 $8,523 $8,163 $7,949 $7,368

807 875 688 11 278 366 370 504

577 514 564 (171) 100 214 269 418

367 347 310 (46) 141 195 147 257

– – 15 31 15 14 11 (28)

367 347 325 (15) 156 209 158 51

375 437 542 378 336 483 418 309

371 386 399 322 318 282 246 241

70 103 102 102 101 100 90 85

3,237 3,177 3,882 4,281 3,812 3,541 3,078 2,708

3,303 2,892 3,267 3,676 4,022 3,829 2,988 2,763

(66) 285 615 605 (210) (288) 90 (55)

2,134 2,178 2,418 2,375 1,798 1,779 1,440 1,319

6,902 6,826 7,935 8,270 8,015 7,800 6,655 6,047

795 714 1,087 1,074 955 983 885 840

1,684 1,867 2,001 1,771 1,926 1,877 1,723 1,648

5.24 4.61 4.09 (0.62) 1.90 2.64 1.98 3.60

5.20 4.56 4.06 (0.62) 1.88 2.60 1.95 3.47

5.20 4.56 4.25 (0.20) 2.08 2.78 2.10 0.71

1.36 1.36 1.36 1.36 1.36 1.36 1.22 1.19

23.84 24.55 26.16 23.71 25.93 25.40 23.21 23.17

47.69 65.06 55.38 55.00 46.63 53.25 50.25 66.50

7.8% 8.3% 6.7% 0.1% 3.3% 4.5% 4.7% 6.8%

5.6% 4.9% 5.5% (2.0)% 1.2% 2.6% 3.4% 5.7%

3.6% 3.3% 3.0% (0.5)% 1.7% 2.4% 1.8% 3.5%

20.7% 17.9% 17.2% (0.8)% 8.2% 11.6% 9.4% 14.2%

5.5% 4.2% 4.6% (0.7)% 1.8% 3.0% 2.8% 4.0%

1.0 x 1.1 x 1.2 x 1.2 x 0.9 x 0.9 x 1.0 x 1.0 x

49.4% 37.7% 43.5% 46.1% 44.2% 45.2% 35.6% 33.8%

9.2 x 14.3 x 13.0 x – 22.4 x 19.2 x 23.9 x 21.2 x

4.2 x 4.1 x 3.2 x – 1.6 x 2.7 x 3.6 x 5.0 x

70,637 76,044 76,507 74,697 77,178 76,812 77,588 76,013

66,265 74,463 76,089 75,262 74,415 74,081 73,845 73,068

11,780 12,531 13,584 10,171 11,033 11,686 11,821 11,438

62,527 62,706 59,885 62,419 49,254 46,546 39,671 40,071

0.3% 7.9% (1.2)% 6.8% 6.3% 20.8% 12.0% 25.8%

in 1998, returns on average stockholders’ equity were 19.9% and 16.5%, and returns on average total assets were 5.7% and 4.3%. Excluding non-recurring items, selected 1997 key ratios would

be as follows: a) Operating profit margin - 4.7%, b) Pre-tax margin – 2.7%, c) Net margin – 2.6%, d) Return on average stockholders’ equity – 12%, e) Return on average total assets – 2.7%,

f) Interest coverage – 3x.

5 Earnings from continuing operations before income taxes and other items, as a percent of sales.

6 Earnings from continuing operations, as a percent of sales.

7 Net earnings (loss) before accounting change, divided by average stockholders’ equity.

8 Net earnings (loss) before accounting change, plus minority interest divided by average total assets.

9 Debt divided by debt, stockholders’ equity and minority interests.

10 Ratio of earnings from continuing operations (before income taxes, accounting change and interest expense) to interest expense.

11 Stock appreciation plus reinvested dividends.

33