United Healthcare 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 UnitedHealth Group

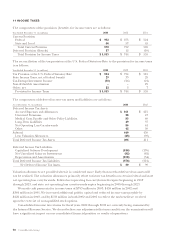

11 INCOME TAXES

The components of the provision (benefit) for income taxes are as follows:

Year Ended December 31, (in millions) 2003 2002 2001

Current Provision

Federal $932 $675 $524

State and Local 46 57 45

Total Current Provision 978 732 569

Deferred Provision (Benefit) 37 12 (10)

Total Provision for Income Taxes $1,015 $744 $559

The reconciliation of the tax provision at the U.S. Federal Statutory Rate to the provision for income taxes

is as follows:

Year Ended December 31, (in millions) 2003 2002 2001

Tax Provision at the U.S. Federal Statutory Rate $994 $734 $515

State Income Taxes, net of federal benefit 29 33 29

Tax-Exempt Investment Income (30) (26) (21)

Non-deductible Amortization – –29

Other, net 22 37

Provision for Income Taxes $1,015 $744 $559

The components of deferred income tax assets and liabilities are as follows:

As of December 31, (in millions) 2003 2002

Deferred Income Tax Assets

Accrued Expenses and Allowances $161 $215

Unearned Premiums 28 47

Medical Costs Payable and Other Policy Liabilities 83 60

Long-Term Liabilities 49 37

Net Operating Loss Carryforwards 86 61

Other 42 30

Subtotal 449 450

Less: Valuation Allowances (43) (39)

Total Deferred Income Tax Assets 406 411

Deferred Income Tax Liabilities

Capitalized Software Development (186) (176)

Net Unrealized Gains on Investments (82) (82)

Depreciation and Amortization (108) (54)

Total Deferred Income Tax Liabilities (376) (312)

Net Deferred Income Tax Assets $30 $99

Valuation allowances are provided when it is considered more likely than not that deferred tax assets will

not be realized. The valuation allowances primarily relate to future tax benefits on certain federal and state

net operating loss carryforwards. Federal net operating loss carryforwards expire beginning in 2012

through 2023, and state net operating loss carryforwards expire beginning in 2005 through 2023.

We made cash payments for income taxes of $783 million in 2003, $458 million in 2002 and

$384 million in 2001. We increased additional paid-in capital and reduced income taxes payable by

$222 million in 2003, and by $133 million in both 2002 and 2001 to reflect the tax benefit we received

upon the exercise of non-qualified stock options.

Consolidated income tax returns for fiscal years 2000 through 2002 are currently being examined by

the Internal Revenue Service. We do not believe any adjustments that may result from the examination will

have a significant impact on our consolidated financial position or results of operations.