United Healthcare 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UnitedHealth Group 29

UnitedHealthcare’s commercial medical care ratio decreased by 230 basis points from 84.1% in

2001 to 81.8% in 2002. Approximately 130 basis points of the commercial medical care ratio decrease

resulted from targeted withdrawals from unprofitable risk-based arrangements with commercial

customers using multiple carriers and a shift in commercial customer mix, with a larger percentage of

premium revenues derived from small business customers. These employer groups typically have a lower

medical care ratio, but carry higher operating costs than larger customers. The balance of the decrease

in the commercial medical care ratio was primarily driven by changes in product mix, care management

activities and net premium rate increases that exceeded overall medical benefit cost increases.

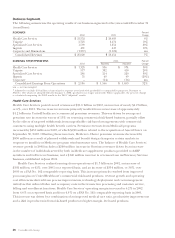

The following table summarizes the number of individuals served, by major market segment and

funding arrangement, as of December 311:

(in thousands) 2002 2001

Commercial

Risk-Based 5,070 5,250

Fee-Based 2,715 2,305

Total Commercial 7,785 7,555

Medicare 225 345

Medicaid 1,030 640

Total Health Care Services 9,040 8,540

1Excludes individuals served by Ovations’ Medicare supplement products provided to AARP members.

The number of individuals served by UnitedHealthcare’s commercial products increased by 230,000, or

3%, during 2002. This included an increase of 410,000, or 18%, in the number of individuals served

with fee-based products, driven by new customer relationships and customers converting from risk-

based products during 2002. This increase was partially offset by a decrease of 180,000, or 3%, in the

number of individuals served by risk-based products, driven by customers converting to self-funded,

fee-based arrangements and UnitedHealthcare’s targeted withdrawal of risk-based product offerings

from unprofitable arrangements with customers using multiple health benefit carriers.

Ovations’ year-over-year Medicare enrollment decreased 35% because of market withdrawals and

benefit design changes. These actions were taken in response to insufficient Medicare program

reimbursement rates in specific counties and were intended to preserve profit margins and better

position the Medicare program for long-term success. Year-over-year Medicaid enrollment increased by

390,000, largely due to the acquisition of AmeriChoice on September 30, 2002, which served

approximately 360,000 individuals as of the acquisition date.

Uniprise

Uniprise revenues were $2.7 billion in 2002, up $251 million, or 10%, over 2001. This increase was

driven primarily by an 8% increase in Uniprise’s customer base. Uniprise served 8.6 million individuals

as of December 31, 2002, and 8.0 million individuals as of December 31, 2001.

Uniprise earnings from operations grew by $135 million, or 35%, over 2001 on a reported basis, and

by $107 million, or 26%, over 2001 on a FAS No. 142 comparable reporting basis. Operating margin

improved to 19.0% in 2002 from 15.4% on a reported basis and from 16.6% on a FAS No. 142

comparable reporting basis in 2001. Uniprise expanded its operating margin through operating cost

efficiencies derived from process improvements, technology deployment and cost management

initiatives that reduced labor and occupancy costs supporting its transaction processing and customer

service, billing and enrollment functions. Additionally, Uniprise’s infrastructure can be scaled

efficiently, allowing its business to grow revenues at a proportionately higher rate than the associated

growth in operating expenses.