United Healthcare 2003 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2003 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 UnitedHealth Group

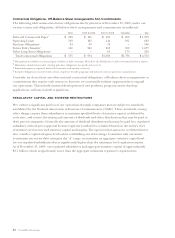

Contractual Obligations, Off-Balance Sheet Arrangements And Commitments

The following table summarizes future obligations due by period as of December 31, 2003, under our

various contractual obligations, off-balance sheet arrangements and commitments (in millions):

2004 2005 to 2006 2007 to 2008 Thereafter Total

Debt and Commercial Paper

1

$229 $400 $900 $450 $1,979

Operating Leases 103 185 144 191 623

Purchase Obligations

2

83 99 14 – 196

Future Policy Benefits

3

160 290 265 962 1,677

Other Long-Term Obligations

4

––65173 238

Total Contractual Obligations $575 $974 $1,388 $1,776 $4,713

1Debt payments could be accelerated upon violation of debt covenants. We believe the likelihood of a debt covenant violation is remote.

2Minimum commitments under existing purchase obligations for goods and services.

3Estimated payments required under life insurance and annuity contracts.

4Includes obligations associated with certain employee benefit programs and minority interest purchase commitments.

Currently, we do not have any other material contractual obligations, off-balance sheet arrangements or

commitments that require cash resources; however, we continually evaluate opportunities to expand

our operations. This includes internal development of new products, programs and technology

applications, and may include acquisitions.

REGULATORY CAPITAL AND DIVIDEND RESTRICTIONS

We conduct a significant portion of our operations through companies that are subject to standards

established by the National Association of Insurance Commissioners (NAIC). These standards, among

other things, require these subsidiaries to maintain specified levels of statutory capital, as defined by

each state, and restrict the timing and amount of dividends and other distributions that may be paid to

their parent companies. Generally, the amount of dividend distributions that may be paid by a regulated

subsidiary, without prior approval by state regulatory authorities, is limited based on the entity’s level

of statutory net income and statutory capital and surplus. The agencies that assess our creditworthiness

also consider capital adequacy levels when establishing our debt ratings. Consistent with our intent

to maintain our senior debt ratings in the “A” range, we maintain an aggregate statutory capital level

for our regulated subsidiaries that is significantly higher than the minimum level regulators require.

As of December 31, 2003, our regulated subsidiaries had aggregate statutory capital of approximately

$3.1 billion, which is significantly more than the aggregate minimum regulatory requirements.