United Healthcare 2003 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2003 United Healthcare annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UnitedHealth Group 49

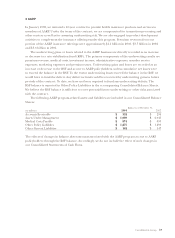

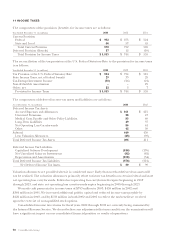

The results of operations and financial condition of MAMSI have not been included in our

Consolidated Statements of Operations or Consolidated Balance Sheets since the acquisition closed

after December 31, 2003. The unaudited pro forma financial information presented below assumes that

the acquisition of MAMSI had occurred as of the beginning of each respective period. The pro forma

adjustments include the pro forma effect of UnitedHealth Group shares issued in the acquisition, the

amortization of finite-lived intangible assets arising from the preliminary purchase price allocation,

interest expense related to financing the cash portion of the purchase price and the associated income

tax effects of the pro forma adjustments. Because the unaudited pro forma financial information has

been prepared based on preliminary estimates of fair values, the actual amounts recorded as of the

completion of the purchase price allocation may differ materially from the information presented

below. The unaudited pro forma results have been prepared for comparative purposes only and do not

purport to be indicative of the results of operations that would have occurred had the MAMSI

acquisition been consummated at the beginning of the respective periods.

2003 2002

(in millions, except per share data) (Pro Forma Unaudited) (Pro Forma Unaudited)

Revenues $31,511 $27,348

Net Earnings $1,971 $1,427

Earnings Per Share:

Basic $3.15 $2.22

Diluted $3.02 $2.12

On November 13, 2003, our Health Care Services business segment acquired Golden Rule Financial

Corporation and subsidiaries (Golden Rule). Golden Rule offers a broad range of health and life

insurance and annuity products to the individual consumer market, and this acquisition provides

UnitedHealth Group with a dedicated business to serve this market. We paid $495 million in cash in

exchange for all of the outstanding stock of Golden Rule. The purchase price and costs associated with

the acquisition exceeded the preliminary estimated fair value of the net tangible assets acquired by

approximately $111 million. We have preliminarily allocated the excess purchase price over the fair

value of the net tangible assets acquired to finite-lived intangible assets of $53 million and associated

deferred tax liabilities of $17 million, and goodwill of $75 million. The finite-lived intangible assets

consist primarily of customer contracts and the present value of future operating profits from life

insurance contracts, with an estimated weighted-average useful life of 14 years. The acquired goodwill is

not deductible for income tax purposes. The results of operations for Golden Rule since the acquisition

date have been included in our consolidated financial statements. The pro forma effects of the Golden

Rule acquisition on our consolidated financial statements were not material. Our preliminary estimate

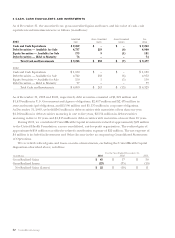

of the fair value of the tangible assets/(liabilities) as of the acquisition date is as follows:

(in millions)

Cash and Cash Equivalents $32

Accounts Receivable and Other Current Assets 98

Long-Term Investments 2,208

Property, Equipment and Capitalized Software 29

Medical Costs Payable (147)

Other Current Liabilities (200)

Future Policy Benefits for Life and Annuity Contracts (1,636)

Net Tangible Assets Acquired

$

384