Ulta 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.An Off-Mall Location. Our stores are predominantly located in convenient, high-traffic locations such as

power centers. Our typical store is approximately 10,000 square feet, including approximately 950 square

feet dedicated to our full-service salon. Our store design, fixtures and open layout provide the flexibility to

respond to consumer trends and changes in our merchandising strategy.

We were founded as a Delaware corporation in 1990 as a beauty retailer at a time when prestige, mass and salon

products were sold through distinct channels — department stores for prestige products, drug stores and mass

merchandisers for mass products and salons and authorized retail outlets for professional hair care products. We

developed a unique specialty retail concept combining one-stop shopping, a compelling value proposition,

convenient locations and a welcoming shopping environment.

The following description of our business should be read in conjunction with the information contained in our

Management’s Discussion and Analysis of Financial Condition and Results of Operations included in Item 7 and

the consolidated financial statements included in Item 8 of this Annual Report on Form 10-K.

Our competitive strengths

We believe the following competitive strengths differentiate us and are critical to our success:

Differentiated merchandising strategy with broad appeal. We believe our broad selection of merchandise

across categories, price points and brands offers a unique shopping experience for our guests. While the products

we sell can be found in department stores, specialty stores, salons, drug stores and mass merchandisers, we offer

all of these products in one retail format so that our guests can find everything they need in one shopping trip.

We offer more than 500 brands, such as Bare Minerals and Urban Decay prestige cosmetics, NYX and

Maybelline mass cosmetics, Coty and Estée Lauder fragrances, Redken and Matrix haircare, as well as

Dermalogica and Philosophy skincare and Clarisonic and CHI personal care appliances. We also offer private

label Ulta products in key categories such as cosmetics, skincare and bath. Because we offer a broad array of

products in prestige, mass and salon, we appeal to a wide range of customers including women of all ages,

demographics and lifestyles.

Our unique guest experience. We combine unmatched product breadth, value and convenience with the

distinctive environment and experience of a specialty retailer. Our well-trained, non-commissioned beauty

advisors provide unbiased and customized advice tailored to our guests’ needs. Our customer service strategy,

convenient locations and attractive store design combine to create a unique shopping experience.

Loyal and active customer base. Approximately fifteen million Ulta guests are members of our loyalty

program. We use this valuable proprietary database to drive traffic, better understand our guests’ purchasing

patterns and support new store site selection. We regularly employ a broad range of media, including digital,

catalogs and newspaper inserts and targeted promotions driven by our CRM platform, to drive traffic to our

stores and website.

Strong vendor relationships across product categories. We have strong, active relationships with over 300

vendors, including Bare Minerals, Coty, Estée Lauder, L’Oréal and Procter & Gamble. We believe that the scope

of these relationships, which span the three beauty categories of prestige, mass and salon, which have taken years

to develop, creates a significant impediment for other retailers to replicate our model. We work closely with our

vendors to market both new and existing brands in a collaborative manner.

Experienced management team.We have an experienced senior management team that brings a creative

merchandising approach and a disciplined operating philosophy to our business. We continue to expand the depth

of our management team at all levels and in all functional areas to support our growth.

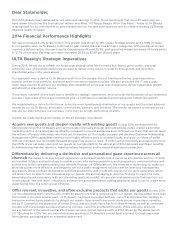

Six strategic imperatives

We are committed to the following six strategic imperatives to drive sustainable long-term growth:

Acquire new guests and deepen loyalty with existing guests. We believe there is an opportunity to use

consumer insights and effective marketing tactics to acquire new guests and increase our “share of wallet” of

existing guests. We have sharpened our brand positioning, and plan to increase awareness of the Ulta brand by

4