Ulta 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

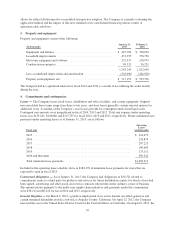

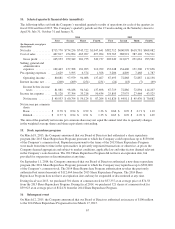

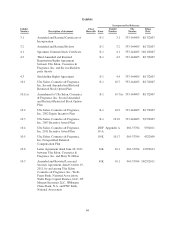

incentive to employees, directors, and consultants to promote the success of the Company’s business. Incentive

compensation was awarded under the Amended and Restated Restricted Stock Option Plan until April 2002 and

under the 2002 Equity Incentive Plan through July 2007, at which time the 2007 Incentive Award Plan was

adopted. All of the plans generally provided for the grant of incentive stock options, nonqualified stock options,

restricted stock, restricted stock units, stock appreciation rights, and other types of awards to employees,

consultants and directors. Unless provided otherwise by the administrator of the plan, options vested over four

years at the rate of 25% per year from the date of grant and most must be exercised within ten years. Options

were granted with the exercise price equal to the fair value of the underlying stock on the date of grant.

2011 Incentive award plan

In June 2011, the Company adopted the 2011 Incentive Award Plan (the 2011 Plan). The 2011 Plan provides for

the grant of incentive stock options, nonqualified stock options, restricted stock, restricted stock units, stock

appreciation rights, performance awards, dividend equivalent rights, stock payments, deferred stock and cash-

based awards to employees, consultants, and directors. Following its adoption, awards are only being made under

the 2011 Plan, and no further awards will be made under any prior plan. As of January 31, 2015, the 2011 Plan

reserves for the issuance upon grant or exercise of awards up to 4,409 shares of the Company’s common stock.

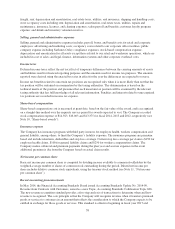

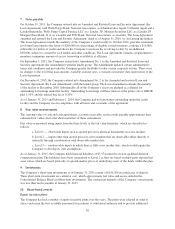

The Company recorded stock compensation expense of $14,923, $16,003 and $13,375 for fiscal 2014, 2013 and

2012, respectively. Cash received from option exercises under all share-based payment arrangements for fiscal

2014, 2013 and 2012 was $10,639, $21,890 and $31,530, respectively. The total income tax benefit recognized in

the income statement for equity compensation arrangements was $3,526, $4,812 and $5,364 for fiscal 2014, 2013

and 2012, respectively. The actual tax benefit realized for the tax deductions from option exercise and restricted

stock vesting of the share-based payment arrangements totaled $6,892, $18,169 and $51,886, respectively, for

fiscal 2014, 2013 and 2012.

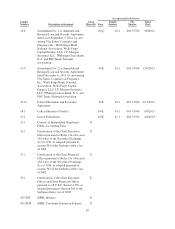

Employee stock options

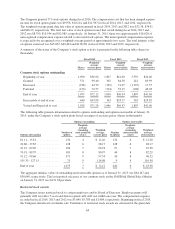

The Company measures share-based compensation cost on the grant date, based on the fair value of the award,

and recognizes the expense on a straight-line method over the requisite service period for awards expected to

vest. The Company estimated the grant date fair value of stock options using a Black-Scholes valuation model

using the following weighted-average assumptions:

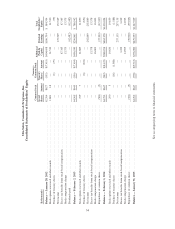

Fiscal

2014

Fiscal

2013

Fiscal

2012

Volatility rate .................................................. 40.7% 49.2% 53.5%

Average risk-free interest rate ..................................... 1.4% 0.9% 1.2%

Average expected life (in years) ................................... 3.8 4.4 6.3

Dividend yield ................................................. None None None

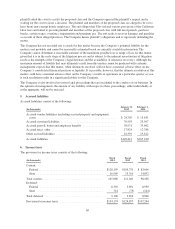

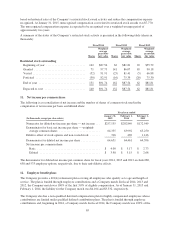

During fiscal 2013, the Company made changes to update the valuation assumptions to Company specific

information. These changes are reflected in the table above and had no material impact on the calculation. For

fiscal 2014 and 2013, the expected volatility was based on the historical volatility of the ULTA Common Shares.

The risk free interest rate was based on the United States Treasury yield curve in effect on the date of grant for

the respective expected life of the option. The expected life represents the time the options granted are expected

to be outstanding. For fiscal 2014 and 2013, the expected life of options granted was derived from historical data

on Ulta stock option exercises. Prior to 2013, we had limited historical data related to exercise behavior since our

initial public offering on October 30, 2007. As a result, the Company elected to use the shortcut approach to

determine the expected life in accordance with the SEC Staff Accounting Bulletin on share-based payments and

the expected volatility was based on the historical volatility of a peer group of publicly-traded companies.

Beginning in fiscal 2013, the Company introduced a forfeiture rate. Forfeitures of options are estimated at the

grant date based on historical rates of the Company’s stock option activity and reduce the compensation expense

recognized. The Company does not currently pay a regular dividend. The dividend paid in May 2012 was a one-

time special cash dividend.

63