Ulta 2014 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

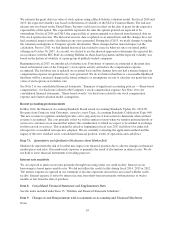

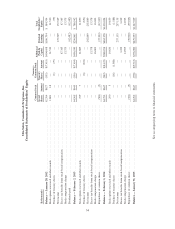

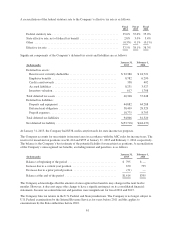

Ulta Salon, Cosmetics & Fragrance, Inc.

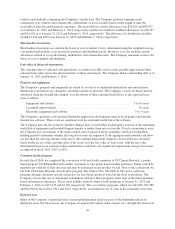

Consolidated Statements of Stockholders’ Equity

Common Stock

Treasury -

Common Stock Additional

Paid-In

Capital

Retained

Earnings

Total

Stockholders’

Equity(In thousands)

Issued

Shares Amount

Treasury

Shares Amount

Balance — January 28, 2012 .................................................. 62,764 $627 (555) $(7,415) $404,698 $186,794 $ 584,704

Stock options exercised and other awards ......................................... 1,801 18 — — 31,512 — 31,530

Purchase of treasury shares .................................................... — — (1) (79) — — (79)

Net income ................................................................. — — — — — 172,549 172,549

Excess tax benefits from stock-based compensation ................................. — — — — 47,345 — 47,345

Stock compensation charge .................................................... — — — — 13,375 — 13,375

Dividends paid .............................................................. — — — — — (62,482) (62,482)

Balance — February 2, 2013 .................................................. 64,565 $645 (556) $(7,494) $496,930 $296,861 $ 786,942

Stock options exercised and other awards ......................................... 729 7 — — 21,883 — 21,890

Purchase of treasury shares .................................................... — — (6) (631) — — (631)

Net income ................................................................. — — — — — 202,849 202,849

Excess tax benefits from stock-based compensation ................................. — — — — 13,378 — 13,378

Stock compensation charge .................................................... — — — — 16,003 — 16,003

Repurchase of common shares .................................................. (501) (5) — — — (37,332) (37,337)

Balance — February 1, 2014 .................................................. 64,793 $647 (562) $(8,125) $548,194 $462,378 $1,003,094

Stock options exercised and other awards ......................................... 290 3 — — 10,636 — 10,639

Purchase of treasury shares .................................................... — — (16) (1,588) — — (1,588)

Net income ................................................................. — — — — — 257,135 257,135

Excess tax benefits from stock-based compensation ................................. — — — — 3,229 — 3,229

Stock compensation charge .................................................... — — — — 14,923 — 14,923

Repurchase of common shares .................................................. (321) (3) — — — (39,920) (39,923)

Balance — January 31, 2015 .................................................. 64,762 $647 (578) $(9,713) $576,982 $679,593 $1,247,509

See accompanying notes to financial statements.

54