Ulta 2014 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Ulta Salon, Cosmetics & Fragrance, Inc.

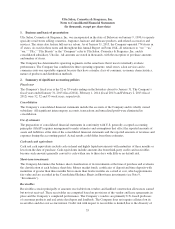

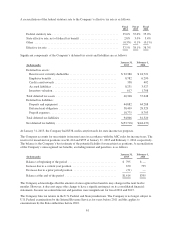

Notes to Consolidated Financial Statements

(In thousands, except per share data)

1. Business and basis of presentation

Ulta Salon, Cosmetics & Fragrance, Inc. was incorporated in the state of Delaware on January 9, 1990, to operate

specialty retail stores selling cosmetics, fragrance, haircare and skincare products, and related accessories and

services. The stores also feature full-service salons. As of January 31, 2015, the Company operated 774 stores in

47 states. As used in these notes and throughout this Annual Report on Form 10-K, all references to “we,” “us,”

“our,” “Ulta,” “Ulta Beauty” or the “Company” refer to Ulta Salon, Cosmetics & Fragrance, Inc. and its

consolidated subsidiary, Ulta Inc. All amounts are stated in thousands, with the exception of per share amounts

and number of stores.

The Company has determined its operating segments on the same basis that it uses to internally evaluate

performance. The Company has combined its three operating segments: retail stores, salon services and e-

commerce into one reportable segment because they have a similar class of consumer, economic characteristics,

nature of products and distribution methods.

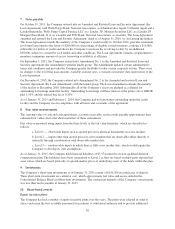

2. Summary of significant accounting policies

Fiscal year

The Company’s fiscal year is the 52 or 53 weeks ending on the Saturday closest to January 31. The Company’s

fiscal years ended January 31, 2015 (fiscal 2014), February 1, 2014 (fiscal 2013) and February 2, 2013 (fiscal

2012) were 52, 52 and 53 week years, respectively.

Consolidation

The Company’s consolidated financial statements include the accounts of the Company and its wholly owned

subsidiary. All significant intercompany accounts, transactions and unrealized profit were eliminated in

consolidation.

Use of estimates

The preparation of consolidated financial statements in conformity with U.S. generally accepted accounting

principles (GAAP) requires management to make estimates and assumptions that affect the reported amounts of

assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and

expenses during the accounting period. Actual results could differ from those estimates.

Cash and cash equivalents

Cash and cash equivalents include cash on hand and highly liquid investments with maturities of three months or

less from the date of purchase. Cash equivalents include amounts due from third-party credit card receivables

because such amounts generally convert to cash within one to three days with little or no default risk.

Short-term investments

The Company determines the balance sheet classification of its investments at the time of purchase and evaluates

the classification at each balance sheet date. Money market funds, certificates of deposit and time deposits with

maturities of greater than three months but no more than twelve months are carried at cost, which approximates

fair value and are recorded in the Consolidated Balance Sheets in Short-term investments (see Note 9,

“Investments”).

Receivables

Receivables consist principally of amounts receivable from vendors and landlord construction allowances earned

but not yet received. These receivables are computed based on provisions of the vendor and lease agreements in

place and the Company’s completed performance. The Company’s vendors are primarily U.S.-based producers

of consumer products and real estate developers and landlords. The Company does not require collateral on its

receivables and does not accrue interest. Credit risk with respect to receivables is limited due to the diversity of

55