Ulta 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

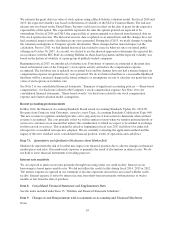

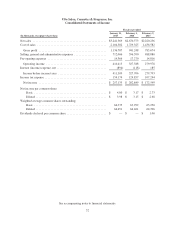

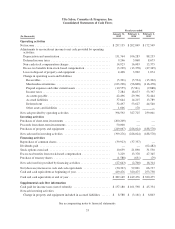

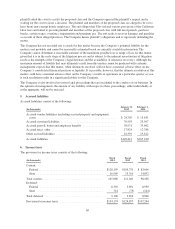

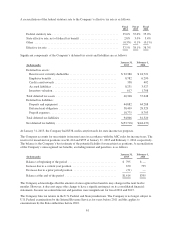

Ulta Salon, Cosmetics & Fragrance, Inc.

Consolidated Statements of Cash Flows

Fiscal year ended

January 31, February 1, February 2,

(In thousands) 2015 2014 2013

Operating activities

Net income ................................................... $257,135 $ 202,849 $ 172,549

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization .................................. 131,764 106,283 88,233

Deferred income taxes ........................................ 9,246 3,868 8,673

Non-cash stock compensation charges ............................ 14,923 16,003 13,375

Excess tax benefits from stock-based compensation ................. (3,229) (13,378) (47,345)

Loss on disposal of property and equipment ....................... 4,468 3,902 1,074

Change in operating assets and liabilities:

Receivables ............................................... (5,391) (5,534) (15,362)

Merchandise inventories .................................... (123,296) (96,808) (116,478)

Prepaid expenses and other current assets ....................... (10,555) (5,541) (9,888)

Income taxes .............................................. 7,284 18,673 53,397

Accounts payable .......................................... 42,496 29,396 32,444

Accrued liabilities ......................................... 37,644 14,215 13,789

Deferred rent ............................................. 32,497 53,627 44,540

Other assets and liabilities ................................... 1,606 170 —

Net cash provided by operating activities ........................... 396,592 327,725 239,001

Investing activities

Purchases of short-term investments ............................... (200,209) — —

Proceeds from short-term investments .............................. 50,000 — —

Purchases of property and equipment .............................. (249,067) (226,024) (188,578)

Net cash used in investing activities ............................... (399,276) (226,024) (188,578)

Financing activities

Repurchase of common shares .................................... (39,923) (37,337) —

Dividends paid ................................................ — — (62,482)

Stock options exercised ......................................... 10,639 21,890 31,530

Excess tax benefits from stock-based compensation ................... 3,229 13,378 47,345

Purchase of treasury shares ...................................... (1,588) (631) (79)

Net cash (used in) provided by financing activities .................... (27,643) (2,700) 16,314

Net (decrease) increase in cash and cash equivalents .................. (30,327) 99,001 66,737

Cash and cash equivalents at beginning of year ....................... 419,476 320,475 253,738

Cash and cash equivalents at end of year ............................ $389,149 $ 419,476 $ 320,475

Supplemental cash flow information

Cash paid for income taxes (net of refunds) ......................... $137,180 $ 101,598 $ 45,354

Noncash investing activities:

Change in property and equipment included in accrued liabilities ...... $ 8,588 $ (3,161) $ 6,803

See accompanying notes to financial statements.

53