Ulta 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

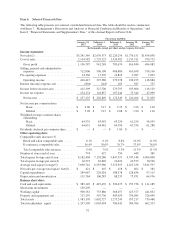

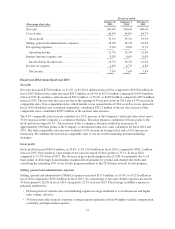

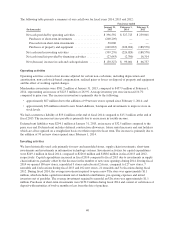

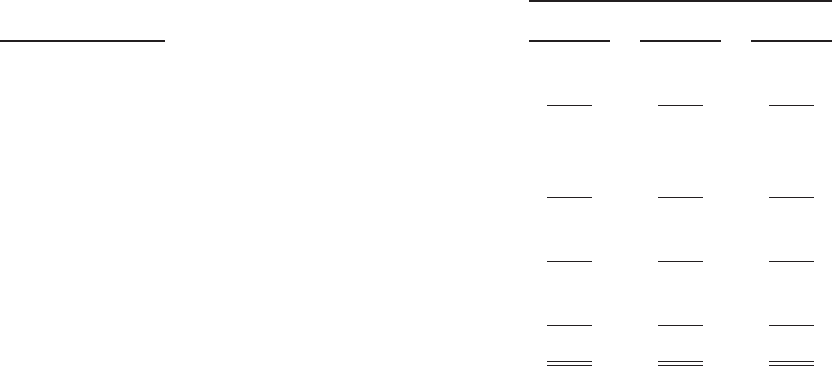

Fiscal year ended

(Percentage of net sales)

January 31,

2015

February 1,

2014

February 2,

2013

Net sales .......................................... 100.0% 100.0% 100.0%

Cost of sales ....................................... 64.9% 64.8% 64.7%

Gross profit ...................................... 35.1% 35.2% 35.3%

Selling, general and administrative expenses .............. 22.0% 22.3% 22.0%

Pre-opening expenses ................................ 0.4% 0.6% 0.7%

Operating income ................................. 12.7% 12.3% 12.6%

Interest (income) expense, net ......................... 0.0% 0.0% 0.0%

Income before income taxes ......................... 12.7% 12.3% 12.6%

Income tax expense .................................. 4.8% 4.7% 4.8%

Net income ...................................... 7.9% 7.6% 7.8%

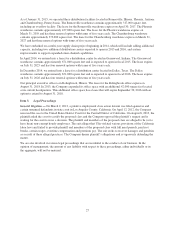

Fiscal year 2014 versus fiscal year 2013

Net sales

Net sales increased $570.8 million, or 21.4%, to $3,241.4 million in fiscal 2014 compared to $2,670.6 million in

fiscal 2013. Salon service sales increased $29.7 million, or 20.4% to $175.5 million compared to $145.8 million

in fiscal 2013. E-commerce sales increased $54.1 million, or 56.4%, to $149.9 million compared to $95.8 million

in fiscal 2013. The net sales increases are due to the opening of 99 net new stores in 2014 and a 9.9% increase in

comparable sales. Non-comparable stores, which include stores opened in fiscal 2014 as well as stores opened in

fiscal 2013 which have not yet turned comparable, contributed $312.3 million of the net sales increase while

comparable stores contributed $258.5 million of the total net sales increase.

The 9.9% comparable sales increase consisted of a 8.1% increase at the Company’s retail and salon stores and a

56.4% increase in the Company’s e-commerce business. The salon business contributed 10 basis points to the

retail and salon comp of 8.1%. The inclusion of the e-commerce business resulted in an increase of

approximately 180 basis points to the Company’s consolidated same store sales calculation for fiscal 2014 and

2013. The total comparable sales increase included a 4.3% increase in average ticket and a 5.6% increase in

transaction. We attribute the increase in comparable sales to our successful marketing and merchandising

strategies.

Gross profit

Gross profit increased $195.6 million, or 20.8%, to $1,136.8 million in fiscal 2014, compared to $941.2 million,

in fiscal 2013. Gross profit as a percentage of net sales decreased 10 basis points to 35.1% in fiscal 2014

compared to 35.2% in fiscal 2013. The decrease in gross profit margin in fiscal 2014 was primarily due to 10

basis points of deleverage in merchandise margins driven primarily by product and channel mix shifts and

converting the remaining 50% of our loyalty program members to the ULTAmate rewards loyalty program.

Selling, general and administrative expenses

Selling, general and administrative (SG&A) expenses increased $115.6 million, or 19.4%, to $712.0 million in

fiscal 2014 compared to $596.4 million in fiscal 2013. As a percentage of net sales, SG&A expenses decreased

30 basis points to 22.0% in fiscal 2014 compared to 22.3% in fiscal 2013. The leverage in SG&A expenses is

primarily attributed to:

‰60 basis points in variable store and marketing expense leverage attributed to cost efficiencies and higher

sales volume; offset by

‰30 basis points deleverage in corporate overhead expense primarily driven by higher variable compensation,

consulting and depreciation expense.

37