Ulta 2014 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2014 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.vendor allowances including co-op advertising, markdowns and volume discounts. We record valuation

adjustments to our inventories if the cost of a specific product on hand exceeds the amount we expect to realize

from the ultimate sale or disposal of the inventory. These estimates are based on management’s judgment

regarding future demand, age of inventory and analysis of historical experience. If actual demand or market

conditions are different than those projected by management, future merchandise margin rates may be

unfavorably or favorably affected by adjustments to these estimates.

Inventories are adjusted for the results of periodic physical inventory counts at each of our locations. We record a

shrink reserve representing management’s estimate of inventory losses by location that have occurred since the

date of the last physical count. This estimate is based on management’s analysis of historical results and

operating trends.

We do not believe that there is a reasonable likelihood that there will be a material change in the future estimates

or assumptions we use to calculate our lower of cost or market or shrink reserves. Adjustments to earnings

resulting from revisions to management’s estimates of the lower of cost or market and shrink reserves have been

insignificant during fiscal 2014, 2013 and 2012. A change in the lower of cost or market reserve of 10% would

have had no material impact on our pre-tax income for fiscal 2014. A change in the shrink rate included in the

shrink reserve calculation of 10% would have had no material impact on our pre-tax income for fiscal 2014.

Vendor allowances

The majority of cash consideration received from a supplier is considered to be a reduction of the cost of the

related products and is reflected in cost of sales in our consolidated statements of income as the related products

are sold unless it is in exchange for an asset or service or a reimbursement of a specific, incremental, identifiable

cost incurred by the Company in selling the vendors’ products. We estimate the amount recorded as a reduction

of inventory at the end of each period, based on a detailed analysis of inventory turns and management’s analysis

of the facts and circumstances of the various contractual agreements with vendors. We record cash consideration

expected to be received from vendors in net receivables at the amount we expect to collect. We do not believe

that there is a reasonable likelihood that there will be a material change in the future estimates or assumptions we

use to calculate our reduction of inventory. A change in inventory turns of 5 basis points would have affected

pre-tax income by approximately $2.4 million in fiscal 2014.

Impairment of long-lived tangible assets

We review long-lived tangible assets whenever events or circumstances indicate these assets might not be

recoverable based on undiscounted future cash flows. Assets are reviewed at the store level, which is the lowest

level for which cash flows can be identified. Significant estimates are used in determining future operating

results of each store over its remaining lease term. If such assets are considered to be impaired, the impairment to

be recognized is measured by the amount by which the carrying amount of the assets exceeds the fair value of the

assets. We do not believe that there is a reasonable likelihood that there will be a material change in the future

estimates or assumptions we use to calculate our impairment charges. We have not recorded any significant

impairment charges in any of the periods presented in the accompanying consolidated financial statements.

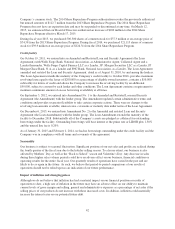

Customer loyalty program

We maintain a customer loyalty program, ULTAmate Rewards, in which program members earn points based on

purchases. Points earned by members are valid for at least one year and may be redeemed on any product we sell.

We accrue the cost of anticipated redemptions related to this program at the time of the initial purchase based on

historical experience. We do not believe that there is a reasonable likelihood that there will be a material change

in the future estimates or assumptions we use to calculate our redemption rates. If our redemption rate were to

change by 5%, it would have affected pre-tax income by approximately $3.2 million in fiscal 2014.

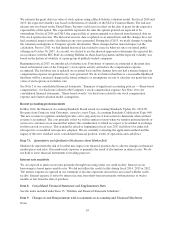

Share-based compensation

We account for share-based compensation in accordance with the Accounting Standards CodificationTM (ASC)

rules for stock compensation. Share-based compensation cost is measured at the grant date, based on the fair

value of the award, and is recognized on a straight-line method over the requisite service period for awards

expected to vest.

44