Suzuki 2005 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2005 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

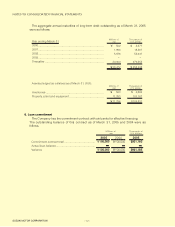

(d) Items related to the calculation standard for the retirement benefit obligation

a. Term allocation of the estimated

amount of retirement benefits : Period fixed amount basis

b. Discount rate : 2005 2.00%

2004 2.00%

c. Assumed return of investment ratio : 2005 0.23% -1.50 %

2004 0.23% -4.39 %

d. Number of years for amortization

of prior service cost : Mainly 15 years

To be amortized by straight line method with

the employees' average remaining service

years at the time when the difference was

caused.

e. Number of years for amortization

of the difference caused by

an actuarial calculation : Mainly 15 years

To be amortized from the next fiscal year

by straight line method with the employees'

average remaining service years at the time

when the difference was caused.

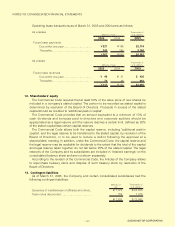

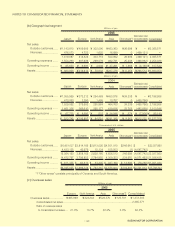

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence

causes were as follows.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

SUZUKI MOTOR CORPORATION −39−

8. Income taxes

Thousands of

U.S. dollars

20042005

Millions of yen

2005

¥ 35,419

33,769

19,892

86,159

¥175,240

¥ (13,577)

(8,090)

(2,363)

(329)

¥ (24,361)

¥150,879

$ 329,822

314,452

185,239

802,300

$1,631,815

$ (126,432)

(75,336)

(22,007)

(3,071)

$ (226,847)

$1,404,967

¥ 35,180

27,045

19,736

75,564

¥157,526

¥ (14,646)

(8,121)

(1,743)

(396)

¥ (24,906)

¥(132,619)

................................................

...........................................

......................

..............................................................

.....................................

Various reserves

Excess-depreciation

Unrealized gross profits elimination

Others

Deferred tax assets total

...........................

...

....................

.....

..............................................................

..................................

.......................

Net unrealized gains on security

Variance from the complete market value method

of newly consolidated subsidiaries

Reserve for fixed assets advanced depreciation

Others

Deferred tax liabilities total

Net amounts of deferred tax assets

Deferred tax assets

Deferred tax liabilities