Suzuki 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

(255.1% as against PFY) due to increased sales etc.

The Suzuki Group has made positive efforts to widen our scope of technical development moving beyond the

areas of current expertise. By offering competitive and original products which are in line with developments in

technical innovation, we are striving to meet the more diversified needs of users under stringent market conditions.

As a result, our R&D expenses increased by 11,940 million yen to 86,856 million yen.

In the previous fiscal year, the net amount of other income and expenses was a loss of 16,268 million yen due to

impairment loss of fixed assets, 17,419 million yen. For this fiscal year, impairment loss of fixed assets was

decreased to 3,774 million yen. As a result,the net amount of other income and expenses was a loss of 488

million.

The next fiscal period is the first year of the "Suzuki Medium term 5-year Plan". The Company will positively

invest in R&D and plants and equipments, however the profit for the Company will decrease in the next fiscal

period as the business environment surrounding the Company is extremely unclear due to the fluctuation of

exchange rates. The Suzuki Group will work together towards innovation in every area, engaging in the evolution

of business activities to achieve 2,500,000 million yen in net sales and 48,000 million yen in net income.

The above is based on the anticipated foreign exchange rate of 1 US dollar = 100 yen and

1 Euro = 134 yen.

*The outlook of business results is an estimate, based on the current information available and assumption,

including risk and uncertainty. It is requested, therefore, to understand that the actual results may vary

extensively as many factors change. Those factors, which may influence the actual results, include economic

conditions, and the trend of demand in major markets and the fluctuation of foreign exchange rates (mainly

the Yen/US dollar rate; Yen/Euro rate).

The net cash provided by operating activities increased to 212,427 million yen. This is 77,853 million yen more

than the previous fiscal year due to an increase in income before tax, and a decrease in income tax paid.

The net cash used in investing activities decreased to 126,102 million yen by 14,876 million yen. This is less

than the previous fiscal year due to proceeds from the sales of marketable securities despite an increase in

expenditure for the purchase of property, plants and equipment.

The net cash used in financing activities increased to 44,058 million yen by 5,171 million yen. This is more than

the previous fiscal year due to repayment of the short-term loan and redemption of bonds.

As a result, the balance of cash and cash equivalents at the end of this fiscal year increased by 43,137 million

yen to 231,397 million yen, compared with the previous fiscal year.

During this fiscal year, we invested a total 136,049 million yen on a number of initiatives, such as new model

production, production volume increase, rationalization, R&D for new models and technical innovation,

distribution, sales channel and IT related investments. The costs of these investments were covered by retained

earnings. Planned capital expenditure spending for the next fiscal year is 214,000 million yen, mainly from our own

funds, but we shall also select proper financial sources depending on the circumstances.

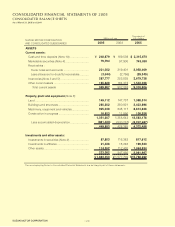

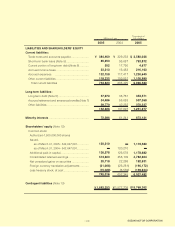

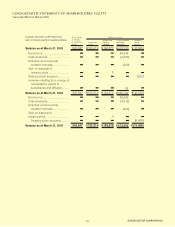

For information regarding significant accounting policies, please refer to the Notes to Consolidated Financial

Statements.

The risks which may possibly affect the operating results, stock price and financial situation of the Suzuki Group

are as follows:

Although the domestic economy continues its process of slight recovery, personal consumption remains

inactive. It is possible that a prolonged sluggish economy and the reduced purchasing will of consumers could

drastically decrease the demand for products, such as motorcycles,automobiles and outboard motors and will

adversely affect the business performances of the Suzuki Group.

The Suzuki Group has business operations all over the world and our dependence on overseas manufacturing

plants, especially in developing countries in the Asian region, has been increasing year by year. Sudden changes

in the economic situation and unexpected events could possibly have an impact on the business performances of

(1) Macro-economic changes

4. Risks in operations

3. Significant accounting policies

(2) Demand for money

(1) Situation of cash flow

2. Liquidity and capital resources

(5) Outlook for results in the next fiscal year

(4) Other income and expenses

(3) Selling, general and administrative expenses

−20−