Suzuki 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION

Ever since establishment, the Suzuki Group has maintained a basic policy of making "value-packed products"

to give our customers satisfaction. The opening paragraph of our company's mission statement promises that we

will "develop products of superior quality by focusing on the customer". Of course, the value of a product varies

with the times as well as the differences between countries and in lifestyles. By keeping on top of the dynamic

changes occurring in the marketplace, we strive to create products of real value, products that are always

designed to win our customers' approval.

We are committed to making positive developments in the production of mini, small and subcompact vehicles.

We are committed to developing vehicles that are environmentally friendly and meet our customers' expectations.

Under our "Small Cars for a Big Future" program, we are working to ensure our operations run in an efficient, well-

coordinated and well-balanced manner.

The Company's basic profit sharing policy is focused on maintaining a continuous and stable payout of

dividends. At the same time, however, from a middle- and long-term perspective, we are always looking at how to

improve our performance, how to increase the dividend payout ratio and how internal reserves can be improved

as a basis for enhancing our corporate structure to allow us to expand our business operations in the future.

The Suzuki Group has a structure in which profits are highly dependent on overseas manufacturing plants.

These are mainly located in developing countries, and are therefore subject to exchange rate fluctuations. We

have plans to actively develop and increase our investment in these overseas manufacturing plants. To achieve

stable growth, we need to further enhance our corporate structure and prepare for unforeseen circumstances.

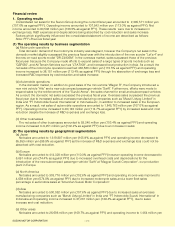

Non-consolidated operating income for the current fiscal year has decreased under such circumstances as

mentioned above. However, the Company achieved over 100 billion yen of consolidated ordinary income for the

first time. To express our appreciation to our shareholders for their support, dividends for the current fiscal year

were approved to be paid at 8.00 yen per share as annual dividends (including interim dividends of 4.00 yen). In

addition, special dividends of 2.00 yen has been paid. Therefore, total dividends are 10.00 yen per share. As a result,

the dividend payout ratio for the current fiscal year is 15.0% and the dividend rate of shareholders'equity is 1.0%.

Note the Company : Suzuki Motor Corporation

ordinary income : obtained by deducting non-operating income and expenses (interest and dividend income, interest expense, etc.) other than special items

from operating income

The Company recognizes that improvement in share liquidity and increasing the number of individual

shareholders are significant issues for achieving a fair price for our shares. Therefore, we have improved the

market environment for investors to purchase shares more easily. From September 2003, the number of shares per

unit was reduced from 1,000 shares to 100 shares. Furthermore, we will continue to take into consideration factors

such as maximization of shareholders' interests, expansion of the number of individual investors, and

improvement of their shares.

In May 2002, the Company unveiled its Medium-term 3-year Plan for a period until March 2005. Upon completion

of that term, we see that sales exceeded the initial target of ¥2 trillion and profits are close to the target figures.

In order for the Suzuki Group to continue to grow as a global corporate entity, the "Suzuki Medium-term 5-year

Plan" has been established for a period up to March 2010. The basic policy of the plan is to promote R&D and

capital investment for further growth, and to establish a revenue base to support those investments, as well as to

develop human resources capable of leading the group to continued growth.

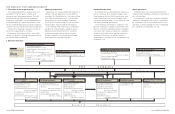

The plan lays out domestic and overseas strategies. In Japan, it calls for strengthened mini, small and

subcompact vehicle sales ability and proactive introduction of new products. Meanwhile, overseas, the plan

provides for an increase in the capacity of plants in India and Hungary that came online ten and

twenty years ago and which are now reaching the limits of their production capacity, as well as capital investment

to improve quality, and the introduction of products tailor-made to suit individual foreign markets.

In light of this, the Company's business objectives are: to raise consolidated sales to over ¥3 trillion (outlined

below), consolidated ordinary income to ¥150 billion, and profitability to over 5% as soon as possible within the

period of the 5-year plan. To this end, the Suzuki Group (the Company, its subsidiaries and affiliates) plans ¥1

trillion in capital investment over five years, and is brimming with enthusiasm to develop new products.

Our worldwide production targets are: 4.4 million motorcycles and 2.7 million automobiles.

The aforementioned ¥3 trillion in sales is broken down as: ¥900 billion in domestically produced and sold

products; ¥900 billion in domestically produced, overseas sold products; and ¥1.2 trillion in overseas produced

and sold products. This marks a significant growth in the latter category.

Each and every one of us in the Suzuki Group will band together to ensure that these target figures are reached

as early as possible in the forthcoming five-year period.

4. Medium-term management strategy

3. Perspectives and policy for lowering the investment unit of shares

2. Profit sharing basic policy

−16−

Management policy

1. Business operations basic policy