Sallie Mae 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

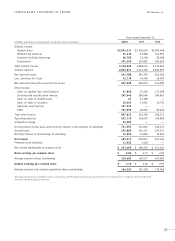

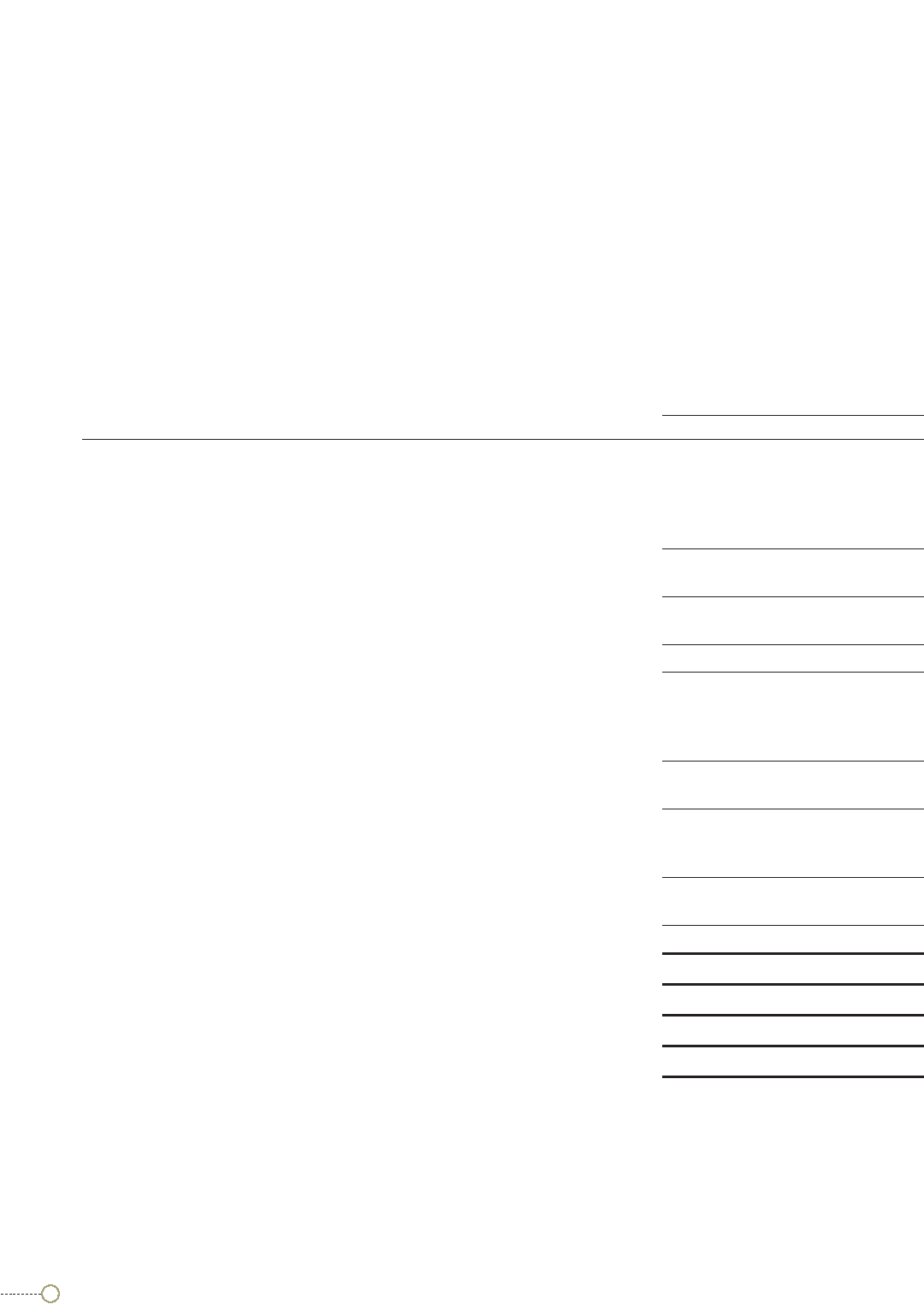

PRO-FORMA “CORE CASH BASIS” CONSOLIDATED STATEMENTS OF INCOME USA Education, Inc.

14

The following pro-forma statements of income present the Company’s results of operations under the assumption that the securitization

transactions are financings, and that the securitized student loans were not sold. As such, no gain on sale or subsequent servicing

and securitization revenue is recognized. Instead, the earnings of the student loans in the trusts and related financing costs are

reflected over the life of the underlying pool of loans. The effect of floor revenue, certain one-time gains on sales of investment

securities and student loans, certain one-time, non-recurring expenses incurred in 1997, a one-time integration charge related

to the July 2000 acquisition of USA Group and the amortization of goodwill from acquisitions also are excluded from net income.

Management refers to these pro-forma results as “core cash basis” statements of income. Management monitors the periodic “core

cash basis” earnings of the Company’s managed student loan portfolio and believes that they assist in a better understanding of

the Company’s student loan business.

Years ended December 31,

(Dollars and shares in thousands, except per share amounts) 2000 1999 1998

Interest income:

Student loans $5,014,858 $3,641,544 $3,311,074

Warehousing advances 56,411 67,828 101,905

Academic facilities financings 66,711 74,358 85,288

Investments 528,957 244,135 298,612

Total interest income 5,666,937 4,027,865 3,796,879

Interest expense 4,627,783 3,101,279 2,905,168

Net interest income 1,039,154 926,586 891,711

Less: provision for losses 52,951 51,289 52,586

Net interest income after provision for losses 986,203 875,297 839,125

Other income:

Gains on sales of securities 1,334 1,303 374

Guarantor servicing fees 127,522 ——

Other 152,349 82,945 86,535

Total other income 281,205 84,248 86,909

Operating expenses 514,093 355,804 360,869

Income before income taxes and minority interest in net earnings of subsidiary 753,315 603,741 565,165

Income taxes 250,128 187,689 173,235

Minority interest in net earnings of subsidiary 10,694 10,694 10,694

Net income 492,493 405,358 381,236

Preferred stock dividends 11,520 1,438 —

Net income attributable to common stock $ 480,973 $ 403,920 $ 381,236

Basic earnings per common share $ 3.02 $ 2.52 $ 2.27

Average common shares outstanding 159,482 160,577 167,684

Diluted earnings per common share $ 2.93 $ 2.48 $ 2.24

Average common and common equivalent shares outstanding 164,355 163,158 170,066