Sallie Mae 2000 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2000 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

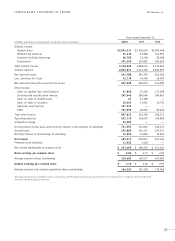

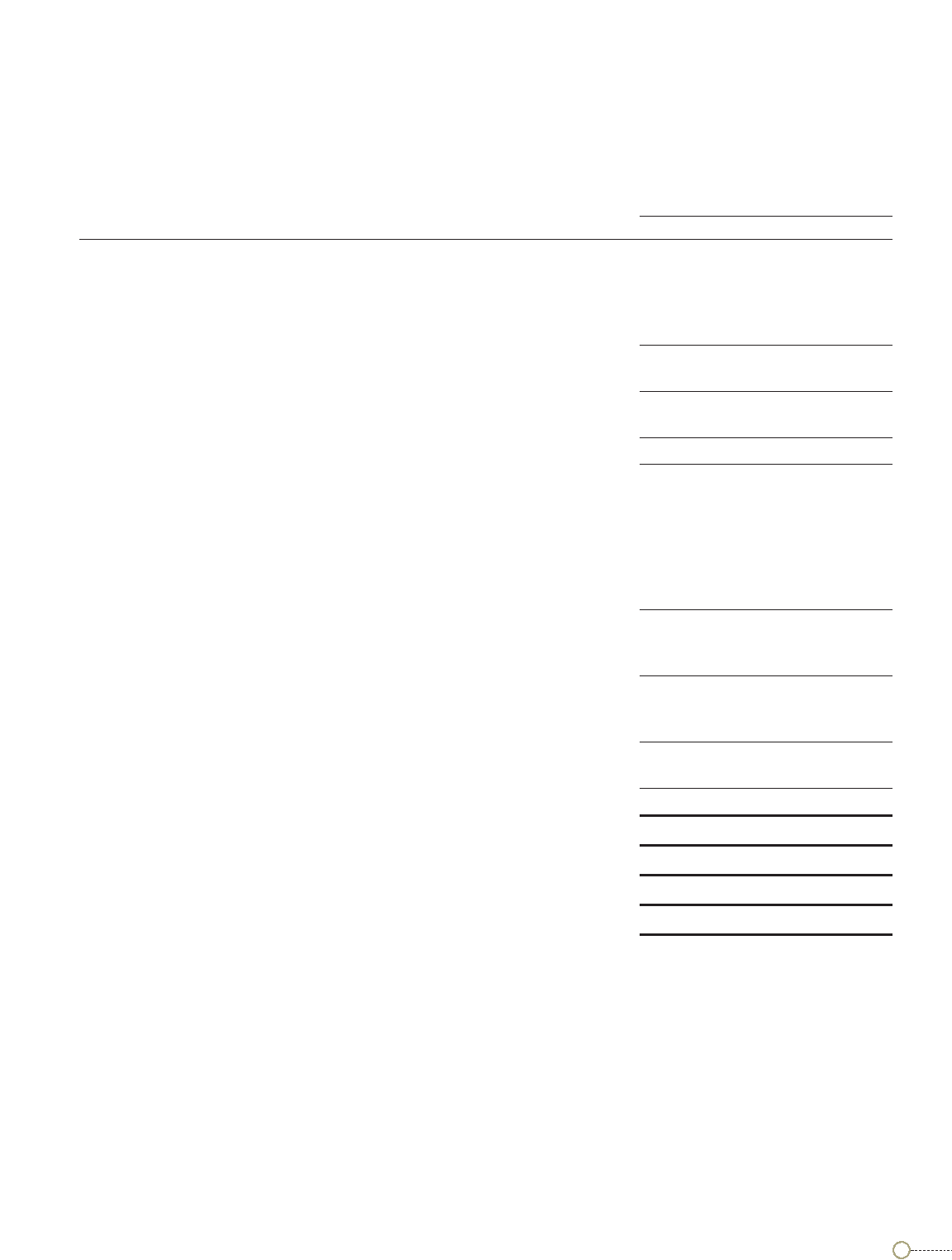

CONSOLIDATED STATEMENTS OF INCOME USA Education, Inc.

Years ended December 31,

(Dollars and shares in thousands, except per share amounts) 2000 1999 1998

Interest income:

Student loans $2,854,231 $2,426,506 $2,094,488

Warehousing advances 56,410 67,828 101,905

Academic facilities financings 66,709 74,358 85,288

Investments 501,309 239,883 294,602

Total interest income 3,478,659 2,808,575 2,576,283

Interest expense 2,836,871 2,114,785 1,924,997

Net interest income 641,788 693,790 651,286

Less: provision for losses 32,119 34,358 36,597

Net interest income after provision for losses 609,669 659,432 614,689

Other income:

Gains on student loan securitizations 91,846 35,280 117,068

Servicing and securitization revenue 295,646 288,584 280,863

Gains on sales of student loans 67 27,169 —

Gains on sales of securities 18,555 15,832 10,734

Guarantor servicing fees 127,522 ——

Other 153,996 83,925 87,646

Total other income 687,632 450,790 496,311

Operating expenses 532,710 358,570 360,869

Integration charge 53,000 ——

Income before income taxes and minority interest in net earnings of subsidiary 711,591 751,652 750,131

Income taxes 235,880 240,127 237,973

Minority interest in net earnings of subsidiary 10,694 10,694 10,694

Net income 465,017 500,831 501,464

Preferred stock dividends 11,522 1,438 —

Net income attributable to common stock $ 453,495 $ 499,393 $ 501,464

Basic earnings per common share $ 2.84 $ 3.11 $ 2.99

Average common shares outstanding 159,482 160,577 167,684

Diluted earnings per common share $ 2.76 $ 3.06 $ 2.95

Average common and common equivalent shares outstanding 164,355 163,158 170,066

The financial statements should be read in conjunction with the financial statements and notes thereto included in the Company's Form 10-K to the

Securities and Exchange Commission.

13