Sallie Mae 2000 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2000 Sallie Mae annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

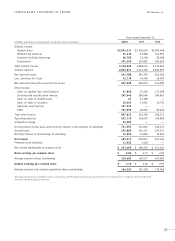

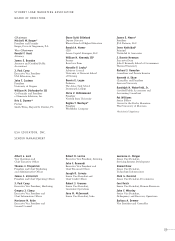

CONSOLIDATED BALANCE SHEETS USA Education, Inc.

December 31,

(Dollars in thousands, except share and per share amounts) 2000 1999

ASSETS

Student loans $37,647,297 $33,808,867

Warehousing advances 987,352 1,042,695

Academic facilities financings 851,168 1,027,765

Investments 5,206,022 5,184,956

Cash and cash equivalents 734,468 589,750

Other assets, principally accrued interest receivable 3,365,481 2,370,751

Total assets $48,791,788 $44,024,784

LIABILITIES

Short-term borrowings $30,463,988 $37,491,251

Long-term notes 14,910,939 4,496,267

Other liabilities 1,787,642 982,469

Total liabilities 47,162,569 42,969,987

Commitments and contingencies

Minority interest in subsidiary 213,883 213,883

Stockholders’ equity

Preferred stock, par value $.20 per share, 20,000,000 shares authorized:

3,300,000 and 3,300,000 shares, respectively, issued at stated value of $50 per share 165,000 165,000

Common stock, par value $.20 per share, 250,000,000 shares authorized:

190,851,936 and 186,069,619 shares issued, respectively 38,170 37,214

Additional paid-in capital 225,211 62,827

Unrealized gains on investments (net of tax of $167,624 and $160,319, respectively) 311,301 297,735

Retained earnings 1,810,902 1,462,034

Stockholders’ equity before treasury stock 2,550,584 2,024,810

Common stock held in treasury at cost: 26,707,091 and 28,493,072 shares, respectively 1,135,248 1,183,896

Total stockholders’ equity 1,415,336 840,914

Total liabilities and stockholders’ equity $48,791,788 $44,024,784

The financial statements should be read in conjunction with the financial statements and notes thereto included in the Company's Form 10-K to the

Securities and Exchange Commission.