Salesforce.com 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

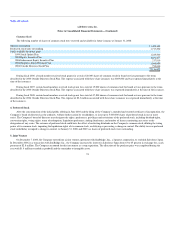

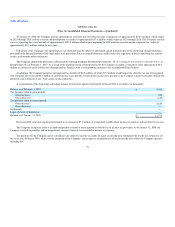

United States, Canada, United Kingdom, Japan and Australia. During the quarter ended January 31, 2008, the Internal Revenue Service initiated an

examination of the Company's federal income tax return for fiscal 2006. This audit may be completed within the next 12 months. While it is difficult to

predict the final outcome of any particular uncertain tax position, management does not believe that it is reasonably possible that the estimates of

unrecognized tax benefits will change significantly in the next twelve months.

8. Commitments and Contingencies

Letters of Credit

As of January 31, 2008, the Company had a total of $5.9 million in letters of credit outstanding substantially in favor of its landlords for office space in

San Francisco, California, New York City, Singapore, Sweden and Switzerland. These letters of credit renew annually and mature at various dates through

December 2015.

Leases

The Company leases office space and equipment under noncancelable operating and capital leases with various expiration dates.

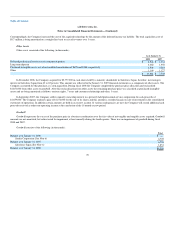

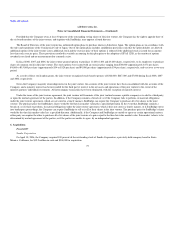

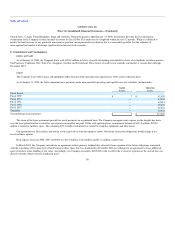

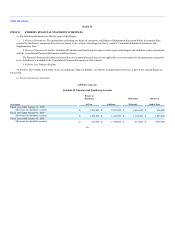

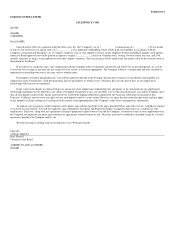

As of January 31, 2008, the future minimum lease payments under noncancelable operating and capital leases are as follows (in thousands):

Capital

Leases

Operating

Leases

Fiscal Period:

Fiscal 2009 $ 7 $ 82,078

Fiscal 2010 — 54,658

Fiscal 2011 — 44,012

Fiscal 2012 — 35,602

Fiscal 2013 — 32,947

Thereafter — 63,932

Total minimum lease payments $ 7 $ 313,229

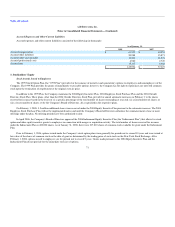

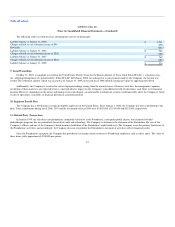

The terms of the lease agreements provide for rental payments on a graduated basis. The Company recognizes rent expense on the straight-line basis

over the lease period and has accrued for rent expense incurred but not paid. Of the total operating lease commitment balance of $313.2 million, $259.8

million is related to facilities space. The remaining $53.4 million commitment is related to computer equipment and other leases.

Our agreements for the facilities and certain services provide us with the option to renew. Our future contractual obligations would change if we

exercised these options.

Rent expense for fiscal 2008, 2007 and 2006 was $23.0 million, $16.8 million and $11.4 million, respectively.

In March 2005, the Company entered into an agreement with its primary landlord that released it from a portion of the future obligations associated

with the remaining 4,000 square feet of San Francisco office space that was abandoned in December 2001 in exchange for an agreement to lease additional

space elsewhere in the building at fair value. Accordingly, the Company recorded a $285,000 credit to reflect the reversal of a portion of the accrual that was

directly related to the previously abandoned space.

80